Last night, for the third Wednesday in a row, I ventured to the Whiteside Theater in downtown Corvallis to watch an old movie. Two weeks ago, it was National Lampoon’s Christmas Vacation. Last week, it was It’s a Wonderful Life. And yesterday was Star Wars. The place was packed! So fun to watch a favorite film in an old theater with a couple of hundred other fans.

I’ve also been watching many movies at home lately. I finally have the time. According to Letterboxd, I’ve seen seventeen films in December. I watched nine in November. I enjoy exploring the nooks and crannies of cinema. (I highly recommend Letterboxd, by the way. I’ve been using it to log my film watching for two years, and I can no longer imagine not using it.)

My days have been busy, too.

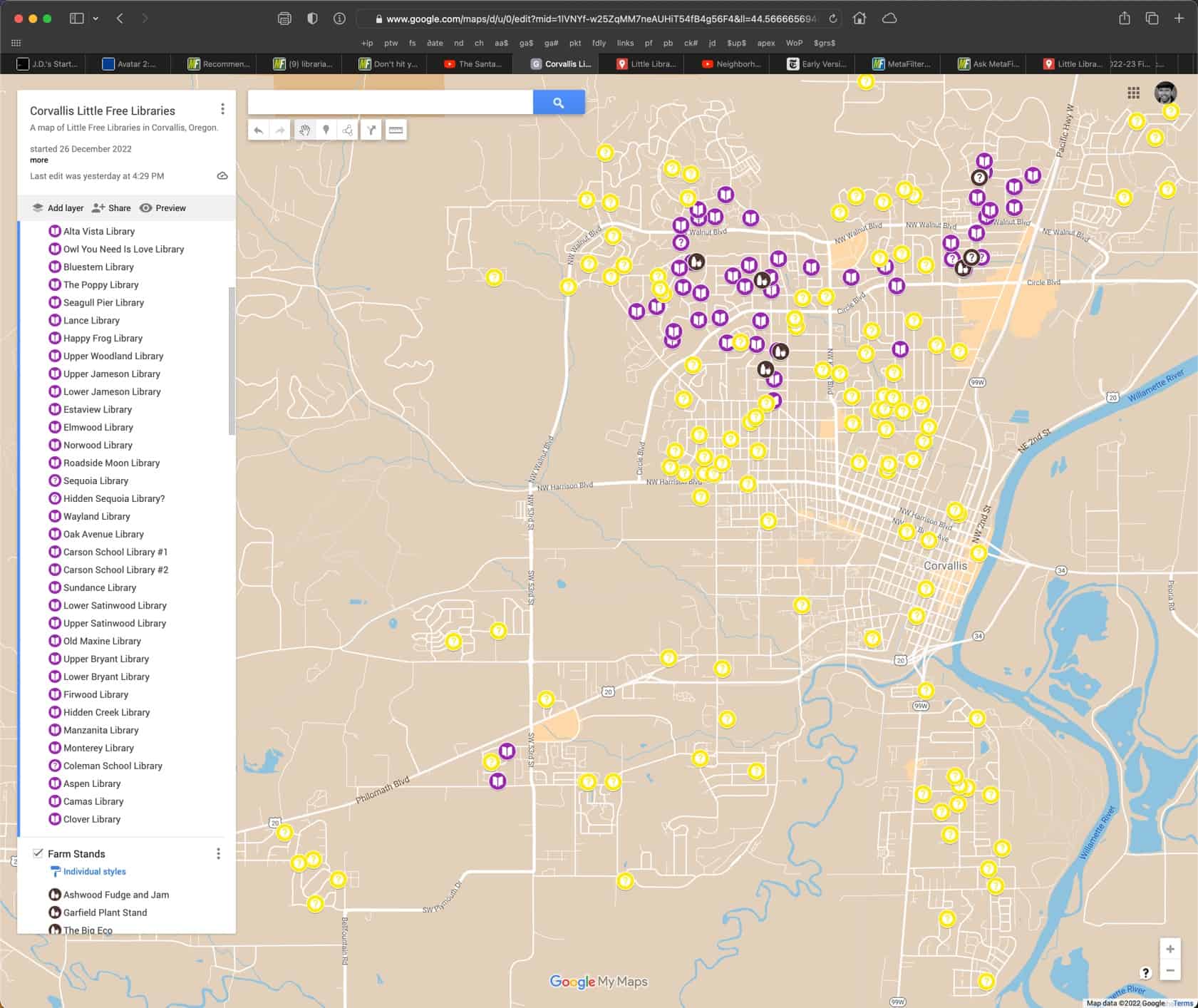

In the mornings, as always, I walk the dog. Lately, though, we’ve been taking longer walks: 90 minutes, two hours. Part of this is because I’ve embarked upon a crazy project to map every Little Free Library and farmstand in town [my map]. But a larger part is because I am, at last, prioritizing fitness again.

Some of you may recall that I lost forty pounds during COVID. I was happy with my fitness going into 2021, but then I got sidetracked by selling a house, buying a house, and a very shitty 2022. I fell into my bad habit of stress eating. I didn’t do any exercise. I gained fifty pounds — everything I’d lost in 2020 and more. Well, for the past three weeks I’ve been both exercising and eating right. I’m back at the gym. In January, I’m joining some friends for a 30-day yoga challenge.

To make it easier to make healthy choices with food, I’ve slowly been re-vamping our kitchen. We’ve lived in this house for fifteen months now, so we have a better idea of where different kitchen tools should live. Plus, after more than a decade with Kim, I’ve decided it’s time to ditch some of our old kitchen stuff (some of which we’ve owned since the 1990s!) and upgrade to better tools. I now own three nice knives, and they’re a joy to use.

Meanwhile, after eighteen months of talking about art, I’ve begun to dabble in it. Not much, but some. Earlier this month, I started a daily art journal. I’m playing with pens and drawing styles. I bought a cheap watercolor set and am having fun playing with that. When I’m not watching movies, I’m often watching art instruction on YouTube.

Plus, I’m doing other fun stuff. I’m reading books and comics. I’m spending more time with friends — both on Zoom and in Real Life.

In short, December has been my best month in a long time. I have been leading a values-driven life and it shows. I can feel it. The people around me can feel it to.

But notice what’s not on that list. What am I not doing? Writing about money. Since my mother died in early October, I’ve been on a deliberate three-month sabbatical. It’s clear that I needed it. It’s also clear that I probably need more time to myself. Like all of 2023.

I mentioned earlier this month that I want to make 2023 the Year of J.D. And it’s true. That’s exactly what I’m going to do. I’m going to prioritize doing what I want when I want it. I don’t mean this in some hedonistic way. I mean it in a “pursuing that which fulfills me” way. Does that make sense?

My number one priority for the coming year is to focus on fitness. Kim and I are doing this together for the first time since we met at Crossfit, and it feels awesome to be on the same page. It’s so much easier to do this as a team. Along with exercise and health eating, I’m also addressing some lingering health issues: blood pressure, sleep apnea, etc.

My number two priority for 2023 is to continue building (and re-building) friendships here in Corvallis. Although I identify as an introvert, it’s clear that I’m not. I need social interaction, and I haven’t been getting enough of it. I’m working on it.

My third priority for the next twelve months is to dive into art. I’ve struggled to start for a couple of reasons.

- First, I don’t know where to start. I’m a complete novice. I’ve never done anything artistic in my life. (Well, not entirely true. In junior high, a buddy and I used to draw our own comic books, but that was kid stuff.)

- Second, I don’t know what kind of art to pursue. Do I want to draw? Do I want to paint? Something else entirely?

This month, I’ve stopped thinking about these sorts of questions and instead begun doing whatever I want with pens and paint. The only way to figure out where to go is to try things. Plus, I’m paying attention to what excites me. Comics excite me, obviously, and always have. But I’m also realizing that I love what I’d call “mid-century spot illustration” style: heavy brush strokes, kind of cartoony.

A final priority is to decide which projects to pursue around the house. Kim and I moved here at the end of August 2021. We love Corvallis, and we know this is where we want to live. Our house is perfectly fine, but…it’s not perfect. (No house ever is.) After “wasting” $150,000+ making changes to our last house then moving after four years, I’m more cautious here. If we stay, I’m willing to spend money and effort to improve things. But if we don’t, I don’t want to expend the resources.

So, Kim and I need to make a decision: Do we commit to staying at this place for, say, a decade or so? Or do we agree that it’s only a temporary place? If we are going to stay, then I have a couple of projects I want to tackle almost immediately. I want remodel a bathroom — maybe two. And I want to give the back yard a major overhaul. (The “bones” of the yard are solid, but the space is overgrown with ferns and weeds after nearly a decade of neglect.)

So, those are my plans for 2023. Again, notice how Get Rich Slowly is not on this list.

I cannot decide what to do about Get Rich Slowly. What role does it play in my life? Does it play a role in my life?

This is part of a larger question about what role I want the internet (and computers themselves, really) to play in my life. Over the past few years, it’s become clear that for me (as with many others, I know) the internet provides just as many problems as it does solutions. And, in fact, I suspect that my recent struggles with mental health have been exacerbated by the internet. Perhaps even caused by the internet.

One option is to simply cut the cord completely and walk away. Sell the site. Give up writing about money forever. Consider it a phase of my life and move on. There are a lot of upsides to this choice, I’ll admit. But I’m not convinced it’s the best option. What if I end up regretting the decision? What if I do decide I want a place to talk about money again?

Besides, there are two big reasons I want to keep Get Rich Slowly (or, perhaps, Money Boss in its stead). For one, I really do want to create an online encyclopedia of personal finance, a place uncluttered by ads and analytics and bullshit, a place where people can get reliable, unbiased money info. Second, and perhaps more importantly, I’m a writer. I express myself through words. I enjoy having an outlet to share what I’m feeling. Just like this!

So, I equivocate.

I go back and forth.

I think and I think and I think about the best course to take.

But you know what? It’s not a decision I have to make right now. Right now, the best thing is to simply do what I’ve been doing. It seems to be working. December has been all about me and my needs, and that’s what 2023 will be too.

In the coming year, I’m going to focus on fitness. I’m going to continue exploring art and watching movies. I’m going to hang out with friends. At long last, I’m going to travel again. (I already have plans to visit Colorado, Mexico, Greece, Ecuador, and more!) I’m going to spend time with Kim and our beasts. I’m going to read. I’m going to cook.

And from time to time — for now, at least — I’ll drop by Get Rich Slowly to share what I’ve been thinking and doing.

Happy holidays, everyone. I’ll see you next year.

Hello, friends. Just a quick note to let you all know that my life, at last, seems to be settling. A full two months after the death of my mother, the fog has lifted and I find that I’m motivated to pursue productive pursuits once more.

I spent much of the past several weeks doing some serious soul-searching. It’s clear to me (and to Kim) that above all else, I need to make 2023 the year of me.

2023 — The Year of Me

More than a decade ago, I got into the habit of theming my years and months. It was fun! It was also fruitful. Whenever I decided to devote a span of time to one thing, I had great results, whether it was with fitness or writing or dating. This habit of theming lasted for a couple of years, then fell by the wayside.

Well, I’ve spent too long putting myself second. Or third. Or ninth. Starting yesterday, my aim is to put myself first for the next year (or more).

This is tough for me. It seems selfish. It seems wrong. But the truth is I’ve been allowing other things to interfere with my pursuit of physical and mental health for too long. I’ve been making excuses. No more! For the foreseeable future, J.D. is job one. Let the age of selfishness commence!

The truth is, of course, that by putting myself first I’m almost certain to become a better person for others — including you. I get that this is so (and, in fact, it’s advice I often give to others), but I’ve been unable to act on the knowledge for too long.

Anyhow, I suspect there’ll be no real change for you, the readers of Get Rich Slowly. The change will mostly be inside of me. I’m giving myself permission to put my needs and desires ahead of everything else for 2023, but I’m almost certain that’ll translate into more fodder for articles around here. And, at long last, completion of the site de-design.

But as part of this Year of Me, I’m deliberately not holding myself to any sort of publishing or production schedule around here. If I have something to say, I’ll say it. If not, I won’t force anything. The post you’re reading is a good example: I just finished another Designing Your Life exercise and have a bit of free time before a call with a friend, so I decided to share a quick update.

Again, this is largely a change inside of me, and I know it. But it’s an important change.

The Courage to Be Disliked

For Thanksgiving, Kim and I drove to California to visit her brother’s family. To pass the time, we listened to The Courage to Be Disliked by Ichiro Kishimi and Fumtitake Koga. This book (which really ought to be titled The Courage to Be Happy) explores the worldview of psychologist Alfred Adler.

The Courage to Be Disliked is packed with loads of wisdom. (I found myself frustrated that I couldn’t highlight passages in an audiobook!) Gems such as these:

- People fabricate anger.

- Learn to live without being controlled by your past.

- Unhappiness is something you choose.

- People generally choose not to change.

- Your life exists in the here and now. (Echoes of Eckhart Tolle, yes?)

- All problems are interpersonal relationship problems.

- Life is not a competition.

- Admitting fault is not defeat.

- Deny the desire for recognition. (Hey! It’s like having a lack of ambition!)

- Discard other people’s tasks. (In other words, set and maintain healthy boundaries.)

- Freedom is being disliked by other people.

- You are not the center of the world.

- The goal of interpersonal relationships is a sense of community.

- Do not rebuke or praise. (This one was a big revelation for both me and Kim.)

- Exist in the present. (Eckhart Tolle again.)

- Excessive self-consciousness stifles the self.

- Don’t pursue self-affirmation; pursue self-acceptance.

- The essence of work is a contribution to the common good.

- Have the courage to be normal.

- Life is a series of moments.

I realize that a lot of those statements probably make zero sense without context. They made zero sense to us too until we listened to the explanations.

I’ll be re-reading The Courage to Be Disliked in Kindle format. Well, I’ll skim it anyhow, searching for the best bits. The book is written like a Socratic dialogue, which is both good and bad. For the purposes of re-reading, I don’t need (or want) to sit through most of the conversation. I’m seeking only the best bits.

It’s very possible that I’ll publish a full review/summary of the book here at Get Rich Slowly in the future.

A Values-Driven Life

To wrap things up, here’s a quote that came up in my Readwise highlights today. I bookmarked this months ago, but it hit home as especially relevant for where I am in this moment:

“The ability to subordinate an impulse to a value is the essence of a proactive person. Reactive people are driven by feelings, by circumstances, by conditions, by their environment. Proactive people are driven by values — carefully thought about, selected, and internalized values.”

— Stephen R. Covey, The 7 Habits of Highly Effective People

One reason I’ve reached a place where I need a Year of Me is that I’ve somehow lost the ability to control my impulses while simultaneously forgetting about my core values. Time to flip the script! I’d already begun to take steps to rein in my impulses — I’ve uninstalled Reddit and Hearthstone from my iPad, for instance — and now it’s time to start putting my values into practice again.

That’s all I have for you today. I’ll be back soon with more, I’m sure, but it might be something short. Or it might be something more conversational…like this. (Really, with what I envision going forward, each of the three sections of this post would have been its own separate article.)

I’m not giving up on longer, focused articles. But for now, for the Year of Me, blog posts like this seem right.

Since late September, I’ve found myself eagerly awaiting new weekly installments of a television show. This hasn’t happened for years. I think the last time I was this excited about a TV show was during the early 1990s when Star Trek: The Next Generation was my drug of choice. (more…)

A memory came to me this morning while I was walking the dog, a memory of those days when I was fresh out of college and just beginning to work for my father at the box factory.

A salesman had come knocking on our door. This was strange since the box factory was (and still is) located in a rural area. But somehow this guy had found us and he was there to make his pitch: He was a salesman who trained salesmen. (And, presumably, saleswomen although this wasn’t part of the spiel in 1992.)

Dad, amused, introduced this fellow to me. “This is J.D.,” Dad said. “He’s our salesman. Talk to him.” So, this guy sat down with me in a back room of the shabby trailer house that served as company HQ. (This was the very trailer house I’d grown up in. And trust me when I say it was a pit, a sty. It was just as bad as you’re imagining. Maybe worse.)

“How would you like to make more money?” the salesman who trained salesmen said to me. He was an older gentleman dressed in a brown corduroy suit.

“I’d love it,” I said. Despite my father’s nepotism in hiring me, I wasn’t paid much: $16,500 per year and no commissions — about $35,500 in 2022 dollars.

“Let me show you what I can do for you,” the salesman said, smiling. That’s my over-riding memory of this conversation: the guy’s permagrin. It never went away. Even when he was resting, he had that shit-eating grin on his face.

Mr. Salesman spent the next ten minutes talking about his services, gently asking leading questions designed to get me to agree with everything he said. Standard salesman stuff. Then, after he’d set me up, he came in with his presumptive close.

“When can I schedule you for training?” he asked.

I sighed.

“You can’t,” I said. “I’m not interested.” And before he could begin working through his canned rebuttals, I elaborated. “I’m not like most salesmen. I’m not ambitious,” I told him. “Yes, I want to make more money, but I don’t want to be King of Sales. Your program sounds fine. Fine for other people, but not for me.” And I showed him to the door.

Dad was puzzled. He’d expected me to jump at the chance to improve my sales skills. Dad was the most ambitious person I’ve ever known. He didn’t understand that I truly wasn’t ambitious.

I hadn’t been ambitious in grade school. I wan’t ambitious in high school. I lacked ambition in college.

I got good grades, performed well on standardized tests, and excelled at a variety of club activities. (I edited the school literary magazines in high school and college. I competed nationally in Future Business Leaders of America.) But none of this was achieved out of any kind of ambition. It was achieved out of interest and passion and intrinsic motivation.

I didn’t achieve because I was after achievement. I achieved because I was doing what I loved.

Allergic to Making Money

A couple of months ago, I made the trek to Orlando to attend Fincon, the annual conference for financial bloggers and YouTubers and podcasters and influencers. One morning, a group of us gathered around an empty conference-room table to kick around ideas and to share how things have been going for us.

This was a great group of folks, people who do good work in the world of personal finance and, more to the point, people who make a lot of money doing so. I always feel a little out of place when I’m with this group. They’re all fine people, but they’re also so much more ambitious than I am. They’re successful (and rich) but they want to be even more successful (and rich). Our discussions are always about how to get more: more readers, more viewers, more publicity, more money.

Eventually the conversation turned to Get Rich Slowly and its status. I talked about how I wanted to convert it to an “online encyclopedia of personal finance”, a go-to destination where people can get reliable, actionable info unclouded by bullshit. I also mentioned that the site only makes $500 per month.

“I don’t get you, J.D.,” said one colleague. “Why are you allergic to making money?”

“Look,” I said. “Here’s the thing. I was born into a poor family. I grew up in a dirty trailer house. What I have today is already so much more than I ever dreamed I’d have. I don’t possess the same ambition that you do. I don’t need to be rich. I don’t need to be famous. I think it’s awesome what you all have accomplished, but I don’t want to do it.”

This is the truth.

When I look at the world around me, it seems as if so many of our problems are caused by ambition. (Note that I’m carefully avoiding use of the word “greed” here. To me, “greed” implies malice. I don’t think many people are actually greedy; they’re just ambitious.) And when I talk about ambition, I mean a sort of selfishness that comes with a lack of empathy, a sort of willing blindness to the consequences of one’s actions and the plights of those less fortunate.

I could make a lot of money, for instance, by pitching credit cards at Get Rich Slowly. If I were an ambitious fellow, I’d probably do that. But having suffered through years of painful credit-card debt myself, I’m unwilling to lure other people into a similar fate.

Sure, I know that credit cards are simply tools and they can be used responsibly. I also know that it’s not my job to protect everyone from debt. But I don’t like the idea of promoting credit cards to people who might damage their lives by using them. It’s like offering whisky to an alcoholic, right? Not everyone who comes to Get Rich Slowly is an “alcoholic”, I know, but many folks are. So, I’d rather not have “whisky” on offer.

Similarly, I’m unwilling to write about the latest app or website or service that’s appeared upon the scene. I’m unwilling to tackle the latest hot topic in the world of personal finance just because it’s a hot topic. I’m unwilling to chase my stories that go viral with other similar stories in the hopes of recapturing some of that same audience. Doing these things is fine for other people, but when I do them it feels like I’m selling my soul.

Unclouded by Ambition

Fincon is an exciting place. It’s fun to talk with people who are “crushing it”, people who have found a niche and who are reaching millions of people each month and/or making millions of dollars per year. How can I help but come away excited and invigorated?

After past Fincons, I’d return home wanting to put into practice all of the ideas I’d picked up at the conference. I’d want to do the things that others were doing to maximize traffic and revenue. I’ve always been drawn to measurable metrics, always been competitive (if not ambitious), so this stuff appeals to me.

But this time, I returned home more resolved than ever to exit The Game. I don’t care about being the biggest. I don’t need to have the most traffic. I have zero interest in capturing an audience, putting them through a “funnel”, and converting their attention into dollars. I don’t like when people do this to me, so why would I want to do it to others?

Plus, this year has been heavy for me. My experiences in 2022 have altered my perspective. More and more, I’m convinced that I want to be doing three things on the internet.

- First, I really do want to convert the bulk of the Get Rich Slowly archive into an online encyclopedia of personal finance. I want to publish definitive and trustworthy articles on the most important topics in personal finance, articles untainted by affiliate marketing and (when possible) political opinion. I want to show people the things that are known to work when it comes to improving home economies.

- Second, I want to publish more personal stories. My own stories, sure — stories like the ones in this post! — but stories from other people too. I truly believe that people learn best through narrative. Theory is great, but nothing compares to lived experience. Stories bind us. They bring us together. They help us learn. They help us understand each other.

- Third, I want to build a small community of folks who are like me: interested in self-improvement, eager to achieve financial security, but equally seeking to help other people make their lives better too. If this small community is five people, great. If it’s 500 people, great. If it’s 5000 people, also great. I’m less interested in quantity than I am quality.

I want to do these three things, and I want to do them in a way that’s unclouded by ambition.

As I said a moment ago, I may not be ambitious but I am competitive. If I’m not careful, I can become too motivated by metrics. I can chase revenue and engagement and all of those other numbers that distract from what’s actually important. But all of those numbers are a trap. Chasing numbers is counter to what I actually want to do with my life.

I want to spend my life telling stories and helping other people — both at the same time, if possible. And I believe that means doing things differently than my colleagues do them. That means casting aside the way things are “supposed to be done” in the world of blogging and YouTubing and Twittering, and it means forging my own path.

This Is the Way

Where does this path lead? I don’t know. I don’t really care, to be honest.

It may be that I spend the next ten years creating content for an audience of dozens and continuing to make a meager $500 per month. (I earned $486.60 from this site in October!) In reality, it’ll probably mean I earn nothing for several years. Why? Because my current intention is to strip the site of all advertising by the end of December.

But I do know this: Wherever I’m headed, I’ll be following a trail I’m blazing myself, not one that’s been laid down by other people. I’ve been on that well-traveled path for a while now, and I don’t like it. I don’t like feeling pressured to create content that gets more views, more clicks, more engagement.

And as I blaze this path, I’m sure to make some wrong turns. I’ll stumble upon some dead ends. I may spend months forging my way in a particular direction only to realize I’ve been going the wrong way. I’m okay with that. That time won’t have been wasted.

So, to belabor this metaphor, I have the machete in hand. I’m ready to hack my way through the undergrowth. Technically, yes, I am on sabbatical until the end of the year. That hasn’t changed. But while I’m “taking a break”, I’ll be casually exploring my surroundings to figure out where I want to begin blazing a path.

Discarding the metaphors, what I think this means in terms of actual work is this:

- At my personal site, I’m going to roll out the “de-design” I’ve been working on. I suspect this means I’ll begin publishing a few articles over there now and then to test things.

- Once I’m certain everything works, I’ll implement the “de-design” here.

- After the cosmetic stuff is in place, I’ll re-arrange some of the structural elements of this site. Part of me wants to scrap everything and start over from scratch, but my colleagues have convinced me this is foolish. I think they’re right.

- When all of this is finished, I hope to begin a regular publishing schedule. But who knows? As a man of no ambition, this might be too much for me. 😉

Meanwhile, I’m sure I’ll publish a few articles here at Get Rich Slowly despite being on sabbatical. In fact, I know I want to write up my most recent experiences with the exercises in the book Designing Your Life. Plus, I do have some thoughts to share about the death of my mother.

Returning to my metaphor, I’m pleased to have you on the trail with me. I’m not sure what we’ll find down these unexplored paths, but I know I’ll enjoy the adventure more with company than I would if I were going it alone. So, pick up your pack. Let’s head out to see what we can find!

One quick postscript: I participated in two written interviews recently, and I think they’re both interesting. The first is about my experience with financial independence. You can read that interview at The Fioneeers: Money Doesn’t Magically Fix Our Problems. The second is a brief conversation about writing with Jacob from The Root of All. You can find that bit at the end of his article about Spending in the Time of COVID.

My mother died Monday night. She was 74.

Earlier this week, I began writing a memorial for her. I know I haven’t talked much about Mom here at Get Rich Slowly, but she probably played the biggest role in molding me into the person I am today. After writing 2500 words, I realized I have a lot to process. And maybe Get Rich Slowly isn’t the place to publish a tribute to her. I don’t know.

![My mother when she was probably 15 years old [My mother when she was probably 15 years old]](https://www.getrichslowly.org/wp-content/uploads/mom-bw.jpg)

In any event, I’m taking some time off.

For the next few weeks, I’ll be dealing with the logistics of Mom’s memorial service and her estate. And while I’m taking time away from Get Rich Slowly to handle these things, it feels like a good opportunity to tackle a few big projects I’ve been putting off — including the “de-design” of this blog.

My plan is to take a three-month sabbatical. I may indeed publish a bit here and there — and I’ll regularly update the “Spare Change” section on the front page and send the GRS Insider email newsletter — but my intention right now is to step away from Get Rich Slowly until the end of the year.

I’ll be back on 01 January 2023.

I am 53 years old. Never in my life have I allowed myself to buy a car I truly love…until now. This is the story of how I allowed myself to make a huge purchase just for the joy of it. And it wasn’t even a purchase I’d intended to make. Let me explain.

During the peak of the pandemic (early July 2020), I paid $35,990 for a used 2019 Mini Countryman SE All4. The Countryman — which I call a “Maxi Cooper” — isn’t a bad car, but I regretted buying it almost immediately. I’d intended to replace my 2004 Mini Cooper with a newer version of the same model, but allowed myself to be talked into a compact SUV.

For two years, I drove the Maxi Cooper and tolerated it. It wasn’t a bad car by any means, but it was a bad car for me. I’m not an SUV guy. I’m a small-car guy.

Last month, I took the Maxi Cooper for an oil change. While I was waiting, the dealer offered to buy it back from me. I wasn’t expecting that.

As you probably know, the used-car market in the U.S. has been crazy for a couple of years. According to the U.S. Federal Reserve, prices on used vehicles are up 55% since July 2020. Prices for new vehicles have also increased during that time, but by only 18%.

Because I write about money, I’m aware that used-car prices are high, but I hadn’t considered that I might sell the car I purchased only two years ago. I’m the sort of person who buys a car and keeps it for a decade or more. But when the Mini dealer told me they’d pay $33,000 for a car I’d bought 26 months earlier, I was intrigued.

I contacted one of my buddies, a former car salesman. “What am I missing here, Jeremy?” I asked. “This seems like a pretty good deal.”

“It’s not just a good deal,” Jeremy said. “It’s a miracle. It’s as if you leased that car for $115 per month. You should take the offer. Now. Before they change their mind.”

Before you read my story, you might want to read this similar story from Liz at Frugalwoods: Why we bought a NEW car. Here’s a relevant excerpt:

“In normal economic times – or rather, in past economic times – used cars were remarkably cheaper than new cars, which made the depreciation on new cars astronomical. In other words, new cars would lose a tremendous amount of their value as soon as they were no longer new.

“Used cars, on the other hand, had a much more gradual depreciation curve, which meant you could buy a used car for a reasonable price and then, if needed, re-sell that used car at a reasonable loss. Currently, thanks to supply chain issues, a shortage of computer chips and inflation, used cars are no longer a deal.”

Unprepared to Purchase

After the Mini dealer offered to buy my vehicle, I immersed myself in car information. As I did, I made myself a promise: For the first (and perhaps only) time in my life, I was going to buy a model I wanted without making compromises.

You see, every car I’ve ever owned has involved some sort of sacrifice. When I was young, the chief compromise was cost. I couldn’t afford more expensive vehicles, so my options were limited. In more recent years, I’ve compromised by buying used. Then by purchasing a compact SUV instead of a sports car. And so on.

This time, I didn’t want to compromise. I wanted to buy exactly the car I wanted. But which car would that be?

Because I hadn’t intended to get rid of my Maxi Cooper, I’d done zero thinking about what kind of car I might buy to replace it. Normally, people figure out what kind of car they want before selling their old one. I was doing things in reverse. I was applying my self-centered shopping strategy to buying a car!

For a time, I considered not replacing the car at all. I still own a 1993 Toyota pickup. It’s ugly, but it works. Plus, Corvallis is a small city with excellent infrastructure for alternative transportation. I walk 20+ miles per week through town and would happily walk more. This summer, I’ve been biking for longer errands too. Going car-free was certainly an option I considered, as was buying another 2004 Mini Cooper. Ultimately, though, I decided to use this opportunity to upgrade to a some sort of new car.

Before we go any farther, it’s important to note a few things about my relationship with automobiles.

- I’m not a car guy. I’m not a motorhead. I don’t obsess over cars and I never have. I do like certain cars, but I’m not normally somebody who buys car magazines or watches car videos.

- I believe that used cars are almost always the smart financial choice.

- I’m in favor of electric cars but think the technology is young, so I’m reluctant to buy in wholly. That said, I made my car search electric-first.

- I like sports cars. I’m not a speed demon, and I don’t need a car to have a high top speed. But I like the styling of sports cars, and I like that they’re “zippy” — they have good acceleration and good handling.

- My #1 source for car info — by far — is Consumer Reports magazine.

- Most of all, I believe in small cars. I always have. I do not undertand the American obsession with large vehicles. It makes zero sense to me. When I rent cars in Europe, I’m always pleased with how many small cars are on the road. They’re almost all small cars.

My ideal car remains a 2004 Mini Cooper — but with modern technology updates to bring it into the world of 2022. Unfortunately, that car doesn’t exist. Modern Minis are larger than they were twenty years ago. Worse, their customer satisfaction scores have eroded. (I also like the Audi A1, but it’s not available in the U.S.)

A Very Short Search

I spent an intense 24 hours researching my options. As I read about cars, I created a list of requirements for my next vehicle. I had a handful of criteria, most of which you can probably guess based on my comments above.

- First, the car had to be small. This limited me to compacts, subcompacts, and sports cars.

- Second, the car had to be fuel efficient. Electric would be nice, but it wasn’t a requirement.

- Third, the car had to be fun. It didn’t have to be fast, but it had to be zippy. It had to handle well.

- Fourth, Consumer Reports had to love it. The car had to get a high reliability rating from the organization, as well as a high road score and a high overall score.

- Fifth, it had to be a car that customers loved. I made the mistake once of purchasing a Ford Focus. Consumer Reports loved the Focus but owners hated it. So did I. It was the most un-fun car I’ve ever owned — like a storage container on wheels.

- Sixth, it had to have a manual transmission. I don’t like driving automatics.

Early in my research, I discovered the Consumer Reports car finder tool. This three-question quiz (which is only available to subscribers) proved helpful.

According to this tool, the five cars best suited to my needs were the Kia Niro Electric, the Ford Mustang Mach-E, the Mazda Miata, the Tesla Model 3, and the Hyundai Ioniq 5.

Although I was tempted, I ruled out the Tesla because (a) it’s too expensive and (b) it has mediocre reliability. I eliminated the Kia and Hyundai because they didn’t earn top owner satisfaction marks. And the electric Mustang isn’t actually a sedan; like my Maxi Cooper, it’s an SUV. (I’m not sure why Consumer Reports recommended SUVs to me when I deliberately left them out of my search parameters.) That left one car: the Mazda Miata.

Here’s the thing: I’ve always been drawn to Miatas. I like how they look. They’re consistently highly-rated by both customers and professional reviewers alike. And they check all of the same boxes for me that the Mini Cooper does.

The Miata quickly soared to the top of my very short list. Also on that list were the Mini Cooper (which I still love despite its drawbacks) and the more-practical Subaru Outback (which is the unofficial state car of Oregon).

Here are comparison pages from Consumer Reports and Kelly Blue Book:

![[Consumer Reports car comparisons] title=](https://www.getrichslowly.org/wp-content/uploads/cr-compare.jpg)

![Kelly Blue Book car comparison [Kelly Blue Book car comparison]](https://www.getrichslowly.org/wp-content/uploads/kbb-compare.jpg)

Looking at those stats, I think you can see why the Miata quickly became the only car I was seriously considering. The car’s only major downside was a middling road score. Reading the Consumer Reports review, I recognized that the reasons for this low road score — road noise and lack of space — didn’t bother me.

The MX-5’s sparkling combination of nimble fun and thriftiness has made it a favorite at our test track — and the current model holds to the standard.

The Miata is a completely impractical car. It seats two (tightly), it will barely haul a load of groceries, and it’s loud inside. Yet we’re smitten with this plucky ragtop.

There isn’t a better fun-per-dollar performance car on the market that delivers the Miata’s magic. After a long winter’s nap, the MX-5 will revive your senses the first spring day you drop the top and hit the curvy roads.

This Mazda is one of the last intimate driving experiences; you feel like part of the machine that’s melding with the road. The Miata’s steering gives immediate turn-in response, and the car remains playful and predictable even when pressing the limits of the tires.

I stopped looking at other models and began trying to find reasons not to buy a Miata. I couldn’t find any.

The Miata reviews on YouTube all reinforced what the written articles had said. But it was this review from a car-care channel that made me decide at last that the Miata was the car I wanted: “It’ll bring joy to your heart every time you drive it.”

Buying My Miata

Buying a car is a big decision, and I’m not accustomed to jumping into things like this. I take my time. I ruminate. I consider every angle. That’s not what I did this time. On the last Thursday in August, I drove to Salem to visit the nearest Mazda dealer.

I’d called the salesman in advance, so he had a Miata ready to drive. Before we left the parking lot (after driving only fifty feet), I knew that I was going to buy a Miata — if I could get $33,000 for my Maxi Cooper. For the sake of show, I drove five miles around Salem streets while making pleasant conversation with the salesman. I explained that I hadn’t intended to buy a new car, but that the Mini dealer had made me an offer I couldn’t refuse. Would he be willing to match the offer? “Maybe,” he said.

When we returned to the dealership, I gave the salesman the file of paperwork for my Maxi Cooper — including the written offer the Mini dealer had made me the day before. He took the info to his boss. Ten minutes later, he came back with some good news. “We’ll match their offer,” he said.

“Great,” I said. I pulled out another piece of paper, a printout from the dealership’s website. “This is the car I want. It’s a gray hardtop. But your website says the vehicle is in transit.”

![[listing for the Miata I wanted] title=](https://www.getrichslowly.org/wp-content/uploads/my-miata-scaled.jpg)

This was the only time during the entire process that the salesman balked. “What can I do to send you home with a car today?” he said. He pulled out a piece of paper and started with the four-square.

“Well, I’m not going home with a car today,” I said. “You don’t have a car that I want. This is the car I want,” I said as I pointed to my printout. The dealership had five Miatas on the lot, but none in the precise configuration I wanted. They were red or automatic transmission or soft-top — or all of the above. I wanted gray, manual transmission, and hard-top. (All Miatas are convertible.)

The salesman nodded. “No problem,” he said. We talked briefly about price but the dealership was unwilling to budge from the $39,245 listed on the website (including a mandatory $1995 markup due to the current car market). I was fine with that. We shook hands and reached a tentative agreement but signed no paperwork. He’d call me when my car came in.

My Miata

As I drove home, I thought about the numbers. To an old guy like me, $40,000 seems like a lot to pay for a car. Even $20,000 seems like a lot to pay for a car. I asked myself if I might not be just as happy in, say, a Chevy Spark? But I knew that wouldn’t be the case. As I said earlier, I’ve compromised on cars my entire life. This once, I wanted to indulge myself.

I realized that the fundamental question I needed to answer was this: Would I rather have (a) the 2019 Maxi Cooper and $7000 -or- (b) a brand-new 2022 Mazda Miata? Thinking about it from this perspective, the answer was easy. I’d choose the Miata every single time!

But maybe I was thinking crazy? Maybe I was being too emotional? (I’m under no delusion that this decision was logical. It was emotional. I’m okay with that. I just didn’t want to make a decision that was so emotional that it crossed over to stupid.)

To double-check, I sought the counsel of two people I trust. First, I asked my buddy Jeff (The Happy Philosopher) what he thought. “Do it!” he said. Then I asked my girlfriend, Kim. I was worried that she’d object. She didn’t object it. “You should absolutely do it,” she said. And so I did it. I bought the Miata.

The Mazda salesman called me on the last day of the August. “Your Miata arrived this morning,” he said. “If you’d like, we can do the deal today.” I stopped what I was doing, drove to Salem, and bought a new car.

![Standing next to my new Miata [Standing next to my new Miata]](https://www.getrichslowly.org/wp-content/uploads/jdmiata.jpeg)

My new Miata was so new that it had only five miles on the odometer. “I’ve been doing this for thirty years,” the finance guy told me as I was signing papers. “I think that’s the lowest number I’ve ever seen on an odometer.”

I took the long way home, driving from Salem to Corvallis on winding riverside roads, then through rolling hills and farmland. The top was down. The sun warmed my skin as the wind blew through my hair. Taylor Swift crooned “Welcome to New York” on the stereo. I smiled, inside and out. The Miata indeed brought joy to my heart.

In June, I wrote that growing up poor messed with my mind, still makes me feel guilty for buying Nice Things. The Miata is unquestionably a Nice Thing. I don’t feel guilty about buying the Miata.

When I think of the choice I made, I’m reminded of Ramit Sethi’s admonition that money should be used to build a rich life. This car is a part of my rich life.

I’ve changed the way I shop over the past few years. And although the shift has been subtle, I’ve found that I’m much happier with the things I buy.

In the past, my approach to shopping was simple. If I wanted a new thneed, I would go to a store (or, with the advent of the internet, a website) and choose from the available thneeds. I’d look at the store’s selection (or the website’s selection) and pick the one best suited for me.

If the thneed I wanted was particularly expensive or important, I might expand my search to multiple stores or multiple websites. But usually, I stuck with the first store I visited.

The key point here is that I allowed the places I shopped to impose limits on the thneeds available to me. I think of this approach as “store-centered shopping”. Whatever the store has in stock defines my universe of options.

Now that I’m older, I’ve flipped the script. Instead of allowing the marketplace to define which thneeds are available to me, I decide exactly what I want before I begin my search. I put myself and my needs first. Once I know what I want, I take the time to locate it. What I want is almost always out there somewhere — if I’m patient enough to track it down.

I think of this approach “self-centered shopping”. I’m putting me first, and that’s a Good Thing. In fact, that’s an Excellent Thing! This method consistently leads to greater satisfaction with the things I buy. Instead of picking up cheap, mass-market thneeds, I’m buying thneeds that feel as if they were specifically made for me.

Let me give you a concrete example.

Buying a Wallet

Every five years or so, I need to replace my wallet. The old one wears out (or gets lost), so I buy a new one.

The way this has always worked for me is simple. My wallet falls apart (or turns up missing), so I head to a nearby department store to look at their selection. I browse the wallets on display, pick the one I like best, then buy it. It becomes my wallet for the next five years.

This is how I’ve always bought wallets since my very first one. I’ve been doing it for more than thirty years.

In 2019, I noticed my wallet was beginning to fall apart again. “Time to buy another,” I thought to myself, and I realized I was dreading the experience. Just as always, I’d go to the store and choose from a wide selection of sameness. But here’s the thing: I don’t like most wallets. They work for other people, but they don’t work for me.

https://www.youtube.com/watch?v=yoPf98i8A0g

I’m not George Costanza. I don’t carry a lot, and I certainly don’t pack much cash. I just need something that fits in my pocket and allows me access to a few cards. I don’t want bulk, and I don’t need leather. I wanted to buy a wallet that worked the way I worked.

Around this time, I happened to walk past a Secrid store. Secrid is a Dutch company that manufacturers minimalist, metal-based wallets. Intrigued, I stepped inside to browse their selection. I nearly bought a Secrid Cardprotector that day, but ultimately decided they were too minimal. (The Cardprotector lets you carry six cards, but that’s about it.) When I left the store, though, I knew I’d use a different approach to buying this wallet.

I made a list of the things I wanted in a wallet. I wanted:

- The slimmest form factor possible. I used the Cardprotector as a baseline: 63mm x 102mm and 40 grams.

- A clear slot for my driver license.

- The ability to carry both my personal credit cards and my business credit cards.

- A place to carry three or four banknotes.

- A little bit of extra room for things like insurance info, my library card, and receipts.

With these parameters in mind, I scouted Amazon. I checked REI. I visited other stores and sites. I found plenty of minimalist wallets – including lots of Secrid knock-offs — but nothing that met my needs.

Then I remembered Tom Bihn. The Tom Bihn company specializes in travel gear. Their Synapse 19 is my go-to backpack not only for daily use, but also for extended international travel. (No joke: I’ve used this simple 19-liter bag for three weeks of European travel before.) Tom Bihn is terrific at packing a lot of features into a small amount of space. Did they sell a travel wallet? They did!

The Tom Bihn minimalist wallet was exactly what I was looking for: three pockets and the same size as the Secrid Cardprotector (but half the weight). If I were to design a wallet for myself, this is what I’d design. I bought one. I’ve been using it ever since, and I love it. (Kim loves it too. She ordered one for herself, and she’ll now often carry that instead of a purse.)

Self-Centered Shopping

My wallet story is a simple example that illustrates my new approach: self-centered shopping. I used to allow stores to define my universe of options, which meant that I rarely bought the thneed I actually wanted. I simply bought the closest thing available to my ideal.

Today, I’m fussier. I’ve learned to take the time to think through what it is I truly want in a thneed before I buy one. I quite literally take out an index card and make a list of requirements so that I don’t forget something important while I’m shopping.

Yes, this self-centered shopping approach is often more expensive, but I’m okay with that. As I get older, my patience for poor quality grows shorter and shorter. When I buy things — especially things I use every day — I want quality. I want them to meet my needs. And, if possible, I want them to be a pleasure to use. To quote Marie Kondo, I want the thneeds I buy to “spark joy”.

I feel like self-centered shopping is one of those things that some people will consider blindingly obvious: “Of course that’s how you should buy things! Why would you do otherwise?” But for me, this is a new concept.

When I was young, our buying choices were limited. We lived in a small town in rural Oregon. Plus, my family was poor. When I wanted to buy a thneed, I could choose from those available at Mangus Variety or Parson’s Pharmacy. That’s it.

Today, though, I’m older, which means I’m more patient. I have more money than I did when I was younger. And, most importantly, the internet exists. When I want a thneed, I’m not limited to the stock on hand at the pharmacy and department store. Without exaggeration, I can buy any thneed in the world…if I can find it. And that’s why I start by defining exactly what it is I want before I begin my search.

This self-centered shopping approach has also drastically reduced my impulse shopping. Turns out I mostly succumb to impulse shopping when I don’t actually know what I want!

Becoming Product Loyal

There’s been an interesting side effect to this self-centered shopping. It’s made me very loyal to specific products from specific companies. When I find something I like, I buy it again and again and again. When it’s time to replace my wallet, for instance, I’ll buy the exact same wallet from Tom Bihn.

Or, take my hiking boots. Every five to seven years, I replace a pair of Timberland Chocorua. (The Amazon history belo0w makes it look like I’m ordering them more often, but that’s because I have two pairs in rotation at once: a “work” pair and a “dress” pair. Each pair lasts five to seven years.)

I’ve been wearing these boots almost daily for fifteen years, much to Kim’s chagrin. I’ll be sad if they’re ever discontinued.

So, my old shopping process was: Realize I need a new thneed, go to the store (or website), and buy the best match.

My new self-centered shopping process is:

- Take time to decide exactly what I want in a thneed.

- Search extensively to find potential matches. Buy one.

- If the thneed works, great. If not, return it and buy something different. (I almost never have to return anything, though, if I’ve taken the time to list the features I want.)

- When I learn a thneed is a perfect match, I buy it over and over.

Looking around my writing desk this morning, I see that most of the things I use every day have now been acquired through self-centered shopping. Here are a few of the tools I bought by searching for exactly what I wanted. These are tools that I buy (or plan to buy) repeatedly because they’re perfect for me.

- Pentel GraphGear 1000 0.5 mm mechanical pencils (except I buy them in blue and red, not pink)

- Pigma Micron 005 pens

- Hobonichi Techo daily planners (although fellow notebook nerd Tanja Hester has convinced me to try the Kokuyo Jibun Techo for 2023)

- Exacompta 100×150 index cards (and Oxford mini index cards)

- Grovemade leather desk pad (and a wool deskpad for the desk return)

Actually, my desk itself was bought my self-centered shopping method. I’d been using a $90 IKEA desk for more than a decade, but it was woefully inefficient. And messy. I hated it. When we moved to Corvallis last year, I took the time to figure out what my “dream desk” would look like. Then I spent a couple of weeks shopping online and off to locate a match. I eventually found an excellent L-shaped traditional desk at a local furniture store, and that’s what I’m using today.

There are still a few tools at my desk that I acquired with my old “buy whatever the store has” method: my microphone, my second monitor (so awful!), my pencil sharpener. But you know what? These things work just fine. I’m in no rush to replace them. When I do replace them someday, I’ll use my self-centered shopping method.

Here’s another reason I think self-centered shopping works so well for me.

When I take the traditional approach to buying a wallet, for example, I go to the store and look at the options. There’s usually forty or fifty wallets from which to choose. It’s overwhelming. I’m paralyzed by the paradox of choice.

With self-centered shopping, though, I don’t have a lot of options. Often, it’s a struggle to find even one perfect match. This means that I can search until I find one product that fits my criteria, then call it a day. I’m not overwhelmed, and I don’t experience the regret that usually comes when you have too many options.

It’s always fun to unearth some esoteric piece of personal finance history. I know there are only a few nerds out there who care (hello, Grant Sabatier!), but those of us who care really care.

Two years ago, I published an article exploring the history of financial independence in which I noted that the earliest reference I can find to the notion of financial independence comes from an 1872 book called Money and How to Make It by H. L. Reade. And it wasn’t until the 1950s that the concept of early retirement (at least in the sense we mean it today) gained traction. But despite my research, I still have questions, such as: What’s the source of the modern FIRE movement?

Who Coined the Term FIRE?

Recently at The Retire Early Home Page — a site so old that it existed (and still exists) at the dawn of the web — John P. Greaney answered the question: Who coined the term FIRE?

If you’ve never visited The Retire Early Home Page, you should. I’m certain that it’s the oldest FIRE site on the web. It’s quite possible it’s the oldest general personal finance site too. Greaney has been publishing quarterly updates since 01 April 1996!

Greaney offers a bit of context and history, writing:

In May 1999 the “Retire Early Home Page” discussion board appeared on The Motley Fool website, and a vibrant conversation on early retirement topics ensued. Before The Motley Fool shut the board down in May 2022 (and converted it to “read-only” status) it had accumulated almost 900,000 posts. […]

One early topic of discussion was the definition of “early retirement” — and the consensus was that some form of financial independence was a prerequisite. Quitting your job with an insufficient nestegg, and risking an early return to paid employment, was more of a “job change” than early retirement.

According to Greaney, on 23 August 2000 a Motley Fool forum member with the handle “fzabaly” was the first to shorten “financially-independent, retired early” to FI/RE in this board post:

One non-monetary decision that has helped me line up FI/RE is attaining a graduate degree (in ComputerScience) while working. Along with the better pay came a higher confidence re: employment that allowed me to become a ‘Moderately Aggressive Investor’ (70% stks/Mfunds) from a Conservative Investor (50% stks/Mfunds).

And, says Greaney, the first person to move this abbreviation from FI/RE to FIRE was a board member going by the handle “wanderer0692”. On 19 January 2001, wanderer0692 made a terrific (and long) post entitled “Things That Are Stronger than Death and Fear”. (The post is worth reading even today, 21 years later.)

“This is the essence of FI/RE,” writes wanderer0692. “Freedom from financial want. It is a tribute, in our case, to luck and a bull market, and to our adherence to what we refer to as the six fundamental principles of FI/RE.”

Those six fundamentals of FI/RE are:

- Have a motivating purpose.

- Take a high-paying job.

- Live below your means.

- Slash your taxes.

- Practice geo-arbitrage.

- Invest in low-cost index funds.

The fundamentals of the FIRE movement haven’t changed much since 2001, have they? These are still the basics that most of people preach and practice today.

“A Fire That Burns in Me”

Anyhow, as a sort of addendum to his excellent post, wanderer0692 makes an observation:

Has anyone else noticed how “FI/RE” looks like the word “fire”? I remember attending church (a long, long time ago) and, during the benediction, the preacher saying, “Take our minds and think through them. Take our eyes and see through them. Take our hearts and set them on fire.” I always liked that turn of phrase.

I’m not much for religion, but I do believe in the sanctity of the human spirit. FI/RE is a fire that burns in me. Maybe it consumes me, but I like to think I am that phoenix, rising from the ashes, to fulfill his special mission of realizing his true potential.

So, from now on, I’m gonna drop the slash. A “FIRE” it is. May it be ever thus.

And so it has been ever thus.

So, there you have it. Until somebody provides evidence otherwise, I’m willing to accept Greaney’s version of early FIRE history. The dude has been writing about this stuff online since 1996, after all. He knows his stuff.

There’s another interesting insight from this FIRE origin story. Today, most people (including me) believe that the FIRE acronym stands for “Financial Independence/Retire Early”. That’s pretty damn clumsy, and we all know it. In actuality, the FIRE acronym originally stood for “Financially Independent, Retired Early”. That makes a lot more sense!

That said, I know it’s a losing battle to try to convince people that we’re mis-labelling what FIRE stands for. Hell, I’ve spent two years trying to get people to stop saying “savings rate” when they mean “saving rate” and I seem to have made zero measurable difference. I suppose I’ll have to resign myself to failure on this one too.

Further Reading

Want to read more about the history of personal finance and financial independence? Well then, you’re a nerd. That’s okay. I’m a nerd too. Here are a few pages that might interest you, weird-o:

- The history of financial independence at Get Rich Slowly

- What early retirement was like in 1957 (according to Life magazine) at Get Rich Slowly

- The Retire Early Home Page (here’s a chronological index)

- “Saving rate” vs. “savings rate” — What’s the difference? at Get Rich Slowly

And please, if you know of any other interesting books or articles about the history of financial independence (and/or personal finance), please let me know. I want to read them.

Last week, I raved about the book Designing Your Life by Bill Burnett and Dave Evans. These two Stanford design professors have taken design principles and applied them to helping people figure out what they want to be when they grow up.

Last week, I raved about the book Designing Your Life by Bill Burnett and Dave Evans. These two Stanford design professors have taken design principles and applied them to helping people figure out what they want to be when they grow up.

After advocating Designing Your Life to several friends, two of them suggested that we work through the book’s exercises together. One of those friends is Kim, my long-term girlfriend. The other is Craig, a college classmate. I thought it might be fun to share some of these exercises as we complete them over the next couple of months.

Because I want to respect the intellectual property of the authors, I’m not going to describe the exercises exactly. Instead, I’ll provide a vague overview and then discuss my own answers. (And, when it makes sense, I’ll also include answers from my friends.)

With that out of the way, let’s dive in! Let’s see what happens as I begin the process of designing my life.

Start Where You Are

The first step to designing your life, say the authors, is to start where you are. I like that advice! In fact, that’s also my advice to folks who are trying to turn around their financial lives: start where you are.

The first step to designing your life, say the authors, is to start where you are. I like that advice! In fact, that’s also my advice to folks who are trying to turn around their financial lives: start where you are.

In the case of life design, Burnett and Evans want readers to perform a self-assessment. This assessment involves honestly evaluating four aspects of your life — health, love, play, and work — by giving each a rating, then writing a short description of the current state of each.

Here’s how I rated these four aspects of my own life:

- Health (37.5%, rising) — After achieving the best fitness of my life a decade ago, I allowed my health to slowly but steadily decline. I’ve arrested this fall and begun to turn things around, but there’s a lot of effort ahead of me if I want to become fit again.

- Love (62.5%, rising) — I’m pleased with the relationship I have with Kim, but we both agree we could prioritize each other more, especially day to day. I also have work to do with my family and friend relationships. The good news is that I’m doing this work, and this area of my life is improving too.

- Play (50%, rising) — I’ve neglected productive play for several years. Kim noted recently that when we met in 2012, I had all sorts of things going on: Spanish lessons, guitar classes, volunteering at a school, Crossfit five times a week. Perhaps because of my marijuana use, I discarded all of those things. My only play involves videogames and anime. I’m in the process of rediscovering productive play.

- Work (56%, rising) — Since I repurchased this site, I’ve struggled to find purpose and clarity with my work. I lost my way. I believe that’s changing; I now have a clear vision for what I want this site to be. I’m not 100% sure how to reach this destination, but that’s fine. I’ll figure it out. The ship is now on course.

This first Designing Your Life exercise isn’t mean to be actionable. It’s an assessment. Like your net worth, this is a snapshot of a moment in time. But once you’ve taken this snapshot, once you’ve determined your location on the “map” of life, it’s time to figure out where you want to go. That involves building a metaphorical compass.

Building a Compass

In the second chapter of Designing Your Life, readers are asked to write two thoughtful mini-essays: a Workview and a Lifeview. These short reflections are meant to be statements of purpose. They are very much like the personal mission statement I encourage my audience to create.

Kim and I haven’t compared the results of this exercise yet, but on Tuesday night Craig and I connected by Facetime to discuss our visions of work and life. I enjoyed this process very much and felt like it helped me appreciate him more as a human being (and a friend). This was, in part, because our responses had a lot of overlap. We share a lot of core values.

With Craig’s permission, I’m going to share his Workview and Lifeview as well as my own. I think you might these interesting.

Workview

Here is Craig’s view of work:

Craig’s Workview

I work for money happily for awhile if it the pay seems fair, but experience, learning, and growth are essential if I am to remain happy for long. Work for money, or status, clouds any effort with petty concerns of parity, competition, and greed. Still, we live in this Capitalist system, cannot escape it on our own, and there are undeniably worse systems.Confidence that the work I am doing is fair, supports life, and does not do permanent harm to natural systems, is important to me. This sort of “right livelihood” is aspirational, and perhaps impossible at certain timescales if all impacts are taken into account.

I most value work that I can see. Producing a tangible product in particular is rewarding. This is perhaps why growing things has always been a part of my life or aspirations. Fostering abundance in the form of food is endlessly satisfying. Tangible tools that enable my work are also satisfying.

I think the most meaningful work possible right now is in restoring natural systems.

And here is my own view of work:

J.D.’s Workview

Work plays several roles for me. It’s my primary means to earn money, of course, but it’s also a chance for me to spend my time in a way that brings me fulfillment while also contributing something to society at large. It’s a way for me to improve my life while also improving the lives of others. I’m fortunate to have found a way to do this while making money. (Right now, though, I make very little money.) I’ve found my ikigai.I want to keep these two ideas — GRS can help me and others simultaneously — in the forefront of my mind as I make work decisions in the future. I want to remain clear on my passion and purpose.

My aim is to transform Get Rich Slowly into a valuable, easy-to-access resource for folks who want to learn how to master their money (and their lives). I want the site to be uncluttered, accurate, and reliable. I want to put the reader first. Ideally, it will produce income for me but I’m okay with that being a lower objective, one that might take time to figure out.

Craig and I were surprised to see that we had similar expectations of work. We understand that work is a means to obtain money. And we both agree that work ought to be fulfilling for us personally. But we both want our work to mean something more, to benefit the world at large.

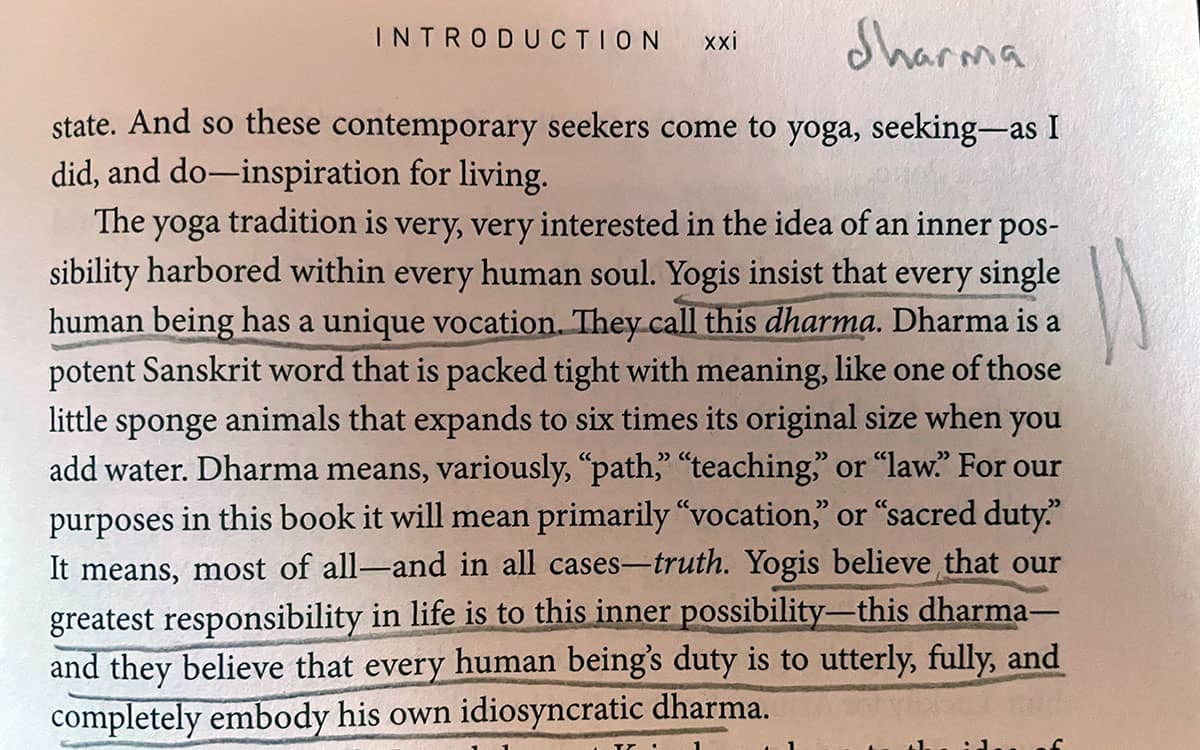

Craig brought up the Buddhist notion of “right livelihood”. I mentioned the Japanese concept of ikigai. All of this reminded me of the discussion of “personal dharma” from Stephen Cope’s book, The Great Work of Your Life.

After a couple of days to think about our discussion, I’d say that both Craig and I want to do work that fosters abundance, that achieves a win-win outcome for us and others.

Lifeview

Next, here are our reflections on the meaning and purpose of life. Note how much overlap we have here. It’s a bit eerie. (We didn’t discuss any of this in advance.)

Craig’s Lifeview

First, do no harm, and also do some good once in awhile, is essential advice for living. I live a rich inner life which has many rewards, but can be selfish when practiced to extremes. Sharing knowledge and insight is rewarding. Giving comfort to others, in whatever form that may take, is still more rewarding.There is no god, but the human search for meaning that inspired the creation of gods can make certain religious traditions and rituals meaningful. The sublime fact that the entire earth is an insignificant dot in the vastness of space, and our lives here an unnoticed blip in the vastness of time, is somehow comforting.

Natural systems will eventually end our lives and use our remains for food, and participation in this cycle is also comforting. In the meantime, if stewarded, nature will shower us with abundance beyond belief.

In the end, laughter is the only reasonable response to life’s vicisitudes. Sharing laughter is perhaps the best way to conquer fear and pain. “For what do we live, but to make sport for our neighbors, and laugh at them in our turn?” – Austen, Pride and Prejudice

And here is mine:

J.D.’s Lifeview

I believe that life has no inherent meaning. This could easily be a source of despair, leading to hedonism and/or antisocial behavior. I choose instead to see it as an opportunity to create my own meaning, to find my own sense of purpose.I believe that morality has nothing to do with which god you worship, which country you live in, which political faction you belong to. Morality is about one thing only: How you treat other people. (And, to a lesser degree, how you treat all living things.)

Morality is about how you treat others. It’s about how you treat those with whom you have a power imbalance. (For instance, how you treat servers or sales staff, how you treat the homeless, how you treat your children or your employees or your pets.) And, especially, how you treat those with whom you disagree. (How Christians treat atheists, for instance, or how Democrats treat Republicans.)

I value curiosity. I value knowledge. I value kindness. I value mutual aid and support. I believe that we grow as individuals when we have deep connections with other people, especially those in our neighborhood and community. So much of the current conflict in our world comes from an unwillingness to engage productively with folks who disagree with us. I want to form bonds with people from all walks of life.

I believe that I can make the most difference in the world by working from the center outward. I must practice rational self-centeredness, putting my needs first (but without depriving others of their needs). From this strong base, I can support Kim. Then my friends and family. And from there, I can focus on improving the world as a whole.

My aim is to leave the world a better place than I found it.

After sharing our Lifeviews with each other, Craig and I discussed the notion of social capital. This is actually an idea that Craig introduced me to nearly twenty years ago when he told me about the book Bowling Alone by Robert Putnam. We agree that social capital seems to have collapsed in the United States — and perhaps the internet is responsible for this. We both would like our lives and work to encourage the growth of social capital.

Not Unto Ourselves Alone Are We Born

Why do Craig and I share such similar worldviews? I’m not 100% sure. It could very well be because we attended the same college (Willamette University) at the same time. I think it’s worth noting that Angela Rozmyn (from Tread Lightly, Retire Early) and I also share similar worldviews. She also attended Willamette.

Why do Craig and I share such similar worldviews? I’m not 100% sure. It could very well be because we attended the same college (Willamette University) at the same time. I think it’s worth noting that Angela Rozmyn (from Tread Lightly, Retire Early) and I also share similar worldviews. She also attended Willamette.

The Willamette University motto is non nobis solum nati sumus, which translates to English as “not unto ourselves alone are we born”. Clearly, both Craig and I have incorporated this notion into our views of work and life. Angela too.

The authors of Designing Your Life say that your Workview and your Lifeview are meant to act as compasses. They provide direction when you’ve lost your way. When you reach a fork in the road, consulting these compasses should help you determine which path to choose.

I think this is a great exercise. In fact, it’s likely that I’ll adapt it to fit my own presentations. I feel as if my workshops on finding purpose have certain gaps. The exercises in Designing Your Life help to fill those gaps.

Next up? Chapters three and four of Designing Your Life. For the next couple of weeks, Craig and I will each be keeping a “Good Time Journal” in which we log our activities and rate how engaged and energized we are by the things we do. Then we’ll use mindmapping to see what we can learn from this journal.

Should be fun!

I am obsessed with the film Everything Everywhere All at Once. From the moment I saw the trailer, I knew the movie was meant for me. I was right. The film’s bizarre blend of action, philosophy, science fiction, taxes, and juvenile humor feels specifically targeted to me and my brain.

For those unfamiliar, here’s a quick plot synopsis.

Evelyn and Waymond Wang own a laundromat. Their business is failing, their marriage is fracturing, and so is their relationship with Joy, their daughter. During a meeting with the IRS, Evelyn is visited by a version of her husband from a parallel universe. He says that the multiverse — all of the many parallel universes — is under attack from an evil being named Jobu Tupaki, and Evelyn is the only one who can save it. The rest of the film is about Evelyn overcoming her skepticism and discovering her true power (and Waymond’s).

This trailer pretty much nails the mood and theme of the film. If this preview intrigues you, you’ll probably like it:

Everything Everywhere All at Once is strange. Very strange. It starts mundane and boring, descends into madness, then ultimately ties everything together in some magical ways. Some people hate it. They can’t finish watching it. That’s too bad, because if you abandon the film during the boring part or the strange part, you never get to the magical part. The tedium and the madness are all part of the journey.

I’ve watched the film five times now (and will likely watch it a sixth later today), and I get something new from each viewing. The movie is rich. And detailed. And layered. In fact, it’s designed for repeat viewing (because frequently there’s no way to know something has meaning the first time through).

The reason the film hits me so hard, I think, is that its themes are aligned with things I’ve been ruminating over throughout 2022. While I was caring for my dying cousin during the spring, I reached some sort of nihilistic nadir. Like Jobu Tupaki, the movie’s “villain”, I decided that nothing matters, that life is inherently meaningless.

At heart, though, I’m a Waymond figure — and I always have been. It didn’t take me long to realize that even if life is inherently meaningless (especially if life is inherently meaningless), then it’s up to each of us to make our own meaning. And that kindness matters.

Then there’s the movie’s wild exploration of the multiverse. I’ve been exposed to this concept repeatedly in 2022, most notably in the novel The Midnight Library by Matt Haig, which has a plot similar to Everything Everywhere All at Once: a woman is trapped in a limbo state between life and death, where she explores the many alternate lives she might have lived.

It’s as if the universe is trying to beat me over the head with a message: “J.D., you bozo, you are not trapped by your current reality. If you’re dissatisfied with this timeline, it’s up to you to create a timeline you like better.”

Message received, Universe.

Designing Your Life

Last week, I re-read a book that helped me understand how to take this esoteric idea and do something practical about it. That book is Designing Your Life by Bill Burnett and Dave Evans. Ostensibly, Designing Your Life is about finding a career that fits you. In reality, it’s about looking at the multiverse and deciding which of the many available universes you want to live in.

Fundamentally, Designing Your Life is a career book targeted at young adults. The material here is derived from a Stanford University course taught by the two authors.

Bill Burnett is the executive director of the Stanford Design Program (and was a part of Apple’s early laptop design team). Dave Evans is the co-director of the Stanford Life Design Lab and a very early employee of Electronic Arts, the videogame company.

Burnett and Evans aim to get students (and readers) to apply principles from the world of design to the process of planning their future. While sometimes this approach (and the terminology associated with it) feels forced, most of the time it works surprisingly well. In fact, I found this book was full of aha! moments.

What does a well-designed life look like? What does that notion even mean? “A well-designed life is a life that makes sense,” the authors write. “It’s a life in which who you are, what you believe, and what you do all line up together.” They call this alignment coherence, and I think it’s an excellent concept.

To build a coherent life, the authors encourage readers to practice five disciplines:

- Curiosity. Curiosity, of course, is about being open-minded, about casting a wide net. The authors want you to explore, to be open to opportunity. Doing so will help you “get good at being lucky”.

- Bias to action. It’s not enough to simply read and think about things. Burnett and Evans want you to act — even if your actions are imperfect. They want you to try things. They want you to fail over and over, because failure is the foundation of success.

- Reframing. People get stuck all of the time, and often this “stuckness” is a result of an inability to shift perspective. Designing Your Life urges readers to reframe problems in order to remove barriers and circumvent perceived roadblocks. (Reading this book helped me realize I do a poor job of reframing problems in my life. I allow myself to stay stuck for far too long, in most cases.)

- Patience. Design, the authors say, is a process. Life design is no different. “For every step forward,” they write, “it can sometimes seem you are moving two steps back.” They advocate what they call prototyping — testing new ideas and solutions. “Life design is a journey,” they say. “Let go of the end goal and focus on the process.”

- Radical collaboration. Lastly, the book urges readers to seek help. Great design requires multiple minds tackling a problem. In designing your life, you want to consult with friends and family and mentors. You want to meet people and ask questions. You want to get input from people you trust.

Because this book is based on an actual college course, it’s filled with exercises. These exercises were quite clearly homework assignments for Stanford students, but for old folks like me they’re useful tools to gain clarity.

One exercise, for instance, asks readers to write a 250-word Workview (a short statement about what you believe work is for and what constitutes good work), a 250-word Lifeview (a short statement describing what you believe makes life worth living), then explore how the Workview and Lifeview clash and/or complement one another.

But the exercise I like the most in Designing Your Life makes me think of the multiverse.

The Many Versions of You

“This life you are living is one of many lives you will live,” write Burnett and Evans. “The plain and simple truth is that you will live many different lives in this lifetime. If the life you are currently living feels a bit off, don’t worry; life design gives you endless mulligans.”

To prove their point, they ask readers to visualize three versions of the future, to create three five-year Odyssey Plans.

An Odyssey Plan is like a roadmap to an alternate universe. It’s a vision of what your life might might like five years from now. And the authors want you to draft three of these so that you can see clearly that there really is a multitude of alternate realities from which to choose.

- Your first plan, they say, should be based on what you currently do.

- Your second plan should be the thing you’d do if the path you’re currently on suddenly vanished.

- And the third plan should be the thing you’d do if money and/or image were no object.

I love this idea. And, in fact, I think of it as a missing link in my own work.

When I’m asked to speak, I generally talk about money and meaning. I lead audiences through exercises designed to help them find purpose in life. My end goal is to help people draft a personal mission statement.

But I’ve always felt that my presentation lacks a certain something. Now I know what that something is: Odyssey Plans (or my own version of this idea). An Odyssey Plan helps to put a personal mission statement into action.

Let me give you a real-life example of what Burnett and Evans are after. (This isn’t exactly their exercise, but it’s the same idea.) Let’s look at three possible futures for me.

Future #1: Get Rich Slowly.