Across the web, I see other financial bloggers sharing their year-end financial summaries. Some folks had good years. Financial Samurai’s net worth increased by 6.5% in 2018. Others had mediocre years. Fritz at The Retirement Manifesto saw his net worth decline by 2.1% thanks to a volatile stock market.

Me? Well, I’m embarrassed to share how my year went financially. It sucked. No, seriously. It was terrible.

My net worth declined by 15.2% in 2018 — nearly $250,000!

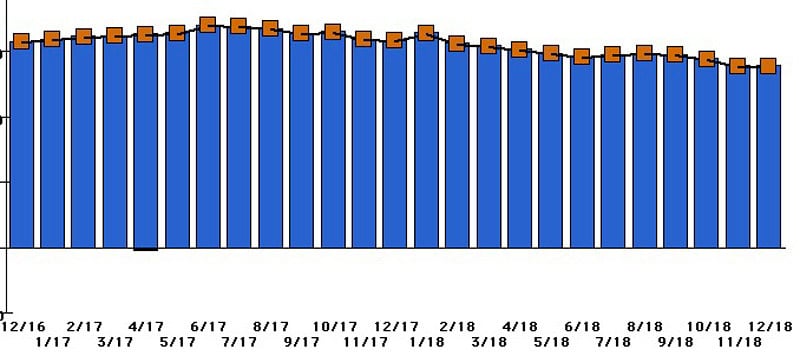

Here’s a graph of the monthly changes to my net worth during the past two years:

What happened? Did I buy a Lamborghini? Did I spend a ton during my recent three-week trip to Europe? Have Kim and I been binging on cocaine and chocolate? Nope. While there’s no doubt that my habits contributed to my loss of wealth, there are larger forces at play here.

Let’s take a closer look.

Note: As a reminder, your net worth is a snapshot of your financial health. It’s what you own minus what you owe. While not a perfect measure, net worth is a useful tool for tracking your financial progress. Want more info? Here’s how to calculate your net worth (and what to do with it).

Three Big Bruises

It’s easy for me to rationalize my huge decline in net worth, to explain that it’s mostly just smoke and mirrors. But I can’t help thinking I’m fooling myself. Let me explain.

My loss of wealth seems to be due to three main factors:

- Ongoing home improvements. Kim and I moved from our penthouse condo to this country cottage eighteen months ago. One of our goals was to reduce the “carrying costs” of owning a home. We achieved that. Living here costs us about $725 less each month than living in the condo. But we’ve also dealt with over $100,000 in necessary home repairs. Holy cats! (And right now, the kitchen sink is leaking. Ugh.)

- The re-acquisition of Get Rich Slowly. I can’t reveal how much I paid to purchase this site from its previous owners, but it’s a significant chunk of change. Plus, I’ve put additional money into GRS for growth and development.

- Investment losses. In 2018, the S&P 500 fell by 6.2%. That hurt my net worth. But I also lost money investing in other small businesses. (I’ll write about this in the future. It’s one of those “it seemed like a good idea at the time” things that’s actually been a poor choice for me.)

It’s obvious how the investment losses effect my net worth, but let’s explore the first two points.

In theory, the improvements we’ve made to our home should increase its value.

We’ve spent a grand total of (drumroll, please) $143,290.09 on remodeling projects since we moved in, which is nearly one-third of the $449,665.36 purchase price. However, that doesn’t mean the home is now worth $587,959.64. (I wish!) I’d be happy if we recouped 50% of our costs, which means our place is probably worth about $516,314.60.

That said, for accounting purposes, I treat remodeling expenses as if that money is simply gone, as if I’d spent it on something disposable. Meanwhile, Zillow says our home is worth $428.068.00. In other words, the combination of home improvements and declining property values has dinged my net worth by $160,000!

A similar thing happened with Get Rich Slowly. Technically, purchasing the site shouldn’t have affected my net worth (assuming it’s worth what I paid). I’m merely converting one asset (cash) into another (the website). However, I’ve never included the value of my businesses in my net worth, and I don’t intend to start. That means (from an accounting perspective), the money I’ve put into this site has vanished.

So, you see, it’s easy for me to rationalize and justify, to explain away my loss of wealth. Easy, yes, but stupid. I am part of the problem.

Lifestyle Inflation and Frictionless Spending

There are some good reasons that my net worth dropped in 2018. But there are some bad reasons too. Some of the drop comes from increased consumerism on my part. To wit:

- Although we’re dining out less than we used to, we’re still spending too much on restaurants. In 2018, I spent an average of $389.63 per month dining out. I’d love to get this number down to about $200 per month.

- Meanwhile, my grocery spending hasn’t decreased at all since moving. In fact, it’s increased by $20 per month. This is ridiculous. We have plenty of low-cost grocery options around us. I need to make use of them.

- I spent a lot on health and fitness in 2018. For much of the year, I was seeing a personal trainer twice per week. I caught pneumonia. I bought a kayak and an expensive bicycle. I had more testing for my sleep apnea. In many ways, I’ve been paying for external motivation to stay healthy. It’s too expensive. I need to shift to internal motivation, which will allow me to get fit for less.

- I’ve been sucked into what my pal Douglas Tsoi calls “frictionless spending”. My Amazon Prime account makes it easy to order whatever I want, whenever I want. My iTunes account makes it easy to find a movie and buy it — with no effort, no “pain of paying”. Companies are finding ways to lower the barrier between impulse and buying. I need to build barriers to spending.

After my divorce in 2012, I was proud that I created a lifestyle that cost me about $3000 per month. This seemed like a completely reasonable amount for the level of luxury it gave me.

When I bought the condo in 2013, my expenses increased to about $4000 per month. While this bothered me a little, I felt like it was a worthwhile price to pay for what I received in return.

After Kim and I returned from our RV trip across the U.S., I found that our lifestyle was costing me closer to $5000 per month. Holy cats! I decided to take action, which is why we moved from the condo to our country cottage.

The trouble is that my monthly expenses haven’t dropped since moving. Yes, the monthly carrying costs on this house are about $725 less than the condo, but I haven’t banked that savings. Instead, I’ve used it to fund lifestyle inflation. I’m still spending about $5000 per month.

This needs to stop.

In Pursuit of Personal Profit

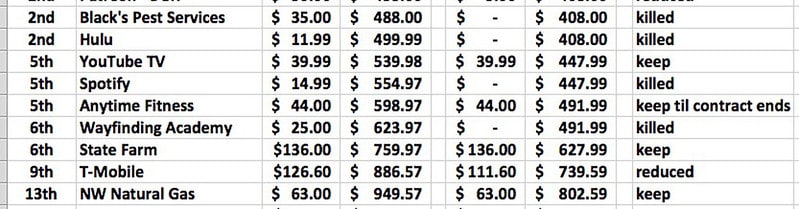

I’ve spent much of the past ten days poring over my finances. I created a spreadsheet of monthly spending, then systematically worked my way through, looking for expenses to cut. With two hours of work, I found $464.27 of recurring costs that I could trim from my budget immediately. That number will increase to $741.97 after a couple of contracts end.

On top of that, I want to change my current spending patterns. How much can I save by curbing my epicurean habits? A ton, I hope. Plus, I plan to build barriers between me and frictionless spending.

Ultimately, I have two financial goals for 2019.

- First, I want Get Rich Slowly to become profitable by the end of the year. Ideally, it’d generate enough income to cover most of my living expenses. (To be fair, the site recently moved from the red to the black, but I don’t have enough data yet to call it profitable long-term.)

- Second, I want to decrease my spending from about $5000 per month to about $4000 per month. (Truthfully, I’d love to cut my expenses to $3500 per month — or lower.)

The bottom line? I want to earn more than I spend in 2019. In my dream world, by the end of the year I’ll have a positive saving rate for the first time since I sold this site in 2009. My goal is for my wealth to grow, not shrink.

I know that I’m in a fortunate position. I have a substantial nest egg and can afford to live well. There are many others for whom living on $4000 per month would seem like luxury, not like cutting back. I get it.

That said, it’s scary to crunch the numbers and see that my net worth declined by $250,000 in one year — especially when all of that money vanished from my regular investment account, the one that contains the pool of cash I need to live on for the next decade until I can access my retirement accounts.

In a way, this situation has brought me full circle. When I started Get Rich Slowly back in 2006, my primary focus was frugality. As I earned and saved more, my attention turned to building wealth. After I sold the site, I was more concerned with maximizing happiness through managed spending. Now, though, I feel like I’m returning to my roots and it’s exciting!

“I bought a kayak and an expensive bicycle.” You had me at those…. 🙂

Much of that decline as you said went into making your real home and virtual home (this home) better. With your mindset I don’t think you have anything to worry about.

My NW went down 3%, I can live with that.

Those are assets. Are they included in your net worth, JD?

I include my car, but mostly because I like tracking its value

I do NOT track things like bicycles and kayaks in my net worth. I don’t track computers either. I do, however, track motorized vehicles. Basically, if it’s a motorized vehicle, a home, or an investment of some sort, I track it.

JD, curious about some of your other goals from last year. How did you do on the alcohol servings?

I’m glad you mentioned “frictionless spending”, it describes the practice so well. What starts out as a nice convenience ends up becoming a costly habit. What I spent mindlessly on Amazon purchases last year was crazy. Honestly, what did I even buy? I couldn’t really even tell you. I’ve resolved to not spend any money on Amazon this month (to start). I removed the default credit card that makes the 1-click purchases super easy and deleted the app from my phone. Astonishingly, Amazon was responsible for my the biggest spending in my budget. I’m hoping to not replace that with some increases somewhere else in my budget.

Dining out was the issue in 2017 and I managed to mostly get that under control in 2018. We spent went out less often, but when we did we spent more! Still managed to spend less overall, but the goal for the year is less total spending on dining out period!

Your other point about not banking any savings also hit close to home.

I’m not sure of the full extended of your pest control, but I’ve found Talstar to be a great product. It is applied quarterly on the exterior of the house for bug control. Check it out on Amazon.

My net worth dropped 6% and I didn’t touch my investments. My side gig consulting fortunately covered everything we spent. It was just falling stock prices that reduced our investments value. We earned over 60k in investment income that we reinvested or it would have been even worse. No worries, it will recover at some point. Having a zero withdrawal rate keeps it all hypothetical feeling.

This year, I calculated two savings rates. I excluded large planned one-time purchases that I had been saving up for from my expenses. This gives me a better picture of my habitual and impulsive spending, which is what I need to focus on for change.

Ha….I remember your blog of long ago used to have lots of articles about frugal living……I remember one especially noteworthy post about frugal ways with toiletry articles and alternatives and between your post and all the comments it was very educational. Maybe it is time to return to some of that old mindset. We appreciate your openness in sharing your financial life with us……it has been a long journey together for many of us here and you started it.

Hey JD. Just saw that you are back. Your blog was always one of my favorites, perhaps because you share your humanity with us along with the well written financial advise. I’m retired and see how easy it can be to slide into excessive spending. After a lifetime of frugality it is difficult to find that middle place between hoarding those savings and watching them fly out of the investment accounts. I’ll be interested in following how you deal with it. And watching for ideas I can use.

JD, the best advice I have found on the predicament you appear to be is on a financial blog you might have heard of. Here is a link: https://www.getrichslowly.org/optimization-trap/

Best wishes for a wonderful 2019.

Hulu has bargains. You can sign up for $5.99 a month. Don’t see it? Call them and ask for it. You really don’t need the HD option. Also, Spotify is free. They play so few ads its almost funny. You don’t need to join a gym. Just go outside and WALK. It’s free.

My networth has stayed about the same. My home value has gone up which offsets any withdrawals I make out of savings. I’m already retired and living off $28,785 a year. You should try it. It’s an eye opener for sure. I allot $50 a month for take-out (Chinese, McDonald’s breakfasts etc). Friday night at our house is pizza night. Hubby makes a mean pizza for only $3. been doing it since 1998. I wouldn’t use Amazon if you paid me. Hate them. I shop online at Walmart instead. At least with Walmart I can stop and think before I make a purchase. And if I don’t like it, I simply return it and get a full refund at one of their many, many local stores. Books I get at the library, especially eBooks and magazines downloaded onto my iPad. For free. I switched from State Farm to Progressive and saved thousands of dollar on my two car insurance policy. Not hundreds. THOUSANDS! For the same exact coverage State Farm was ripping me off for. Put my home & RV with Progressive also and they eliminated the monthly fees (sometimes $9 a month!) they charged for balanced billing.

Hi JD!

Welcome back and HNY!

Although the drops sounds big, it’s safe to say you’re being too hard on yourself by $70,000 on your home and the price you paid for GRS. I’m sure GRS will make a nice return this year.

Therefore, congrats on a decent year! Enjoying the hot tub?

Is this the first time you reveal your net worth?

Sam

Hey, Sam. I explicitly revealed my net worth at Money Boss for a while. Now, I’m not hiding it, but I’m making people do math to figure it out. 😉

Ah, cool. Damn, according to my math you’re a millionaire! 🙂

I honestly don’t think your net worth is down $250K. At most, it’s down $80K if I guess you bought GRS back for $100K and lost $70K from remodel.

How does it feel to be down only 5% for 2018? Whoo hoo!

Sam

J.D., thank you for being honest with us about how last year went for you financially. This is one reason I keep coming back to GRS, I feel like you are the real deal and share downs as well as ups.

Yo, I hear you. Our net worth dropped about 8%. Ouch, but Stay the Course is the word here. Altogether, I’m an aggressive investor, although I spent the past 18 months converting a chunk of equities into a CD ladder to spend during the first five years of my upcoming retirement, which is rather conservative, and glad I did. Meanwhile, I’ve also found that our spending has been creeping, creeping, creeping. So easy for that to happen.

THANKS for the inspiration to sort through our expenses again—while we are generally frugal, it’s been a couple of years since I’ve done this systematically, and a lot of little monsters come to light when you open Pandora’s budget box…..

Good to have you back—guests posts were good, but missed your writing and perspective.

PS…hope you were nowhere near the Xmas market attack in Strasbourg…

Thanks for the update (I’ll post a link on my blog to it) – very good info. One of the reasons I like these “end of year” updates from folks is to see how I am doing in comparison, and to get ideas on how I can improve. I know you aren’t happy with how you did, but I think everyone “took a step back” in 2018. At least you were (and still are) pursuing good goals and moving forward. Looking forward to more writing from you in 2019.

Can all good and decent bloggers – like you – please stop any manner of promotion or publicity for financial samurai’s blog in response to his mean, petty, rude, childish, and ghastly article about Mr Money Mustache’s divorce? I’ve never read a worse blog entry in the FIRE space. It’s a shame to see you send blog traffic to a guy who trashed your friend.

It took me a while, but I found the post you’re referring to. I hadn’t seen it until now. From my perspective, it doesn’t trash MMM. It uses his divorce as an excuse to bring up something unrelated that happened six years ago, yes, but that seems like a genuine reaction to Sam getting his feelings hurt. Plus, the article tackles an ancillary issue: the effect of divorce on children. Sam believes that it’s wrong to get a divorce if you have children at home still. (I disagree and don’t see the logic there but hey…)

That said, here’s the thing: When I link to somebody or something, I’m not saying that I agree with 100% of what that person (or thing) is saying. I’m saying: “Go read this ONE thing. It’s interesting.” I am not a Christian, but I link to lots of Christian-based articles. That’s not me endorsing Christianity. It’s me saying, “You might like this.” I link to articles written by people who are die-hard conservatives and people who are die-hard liberals. That’s not me endorsing any particular ideology. It’s me saying, “This is a good article.” If Hitler had written something savvy about money, I’d point people to it. Not kidding.

I do not have the time (nor the desire) to keep a scoresheet of what everyone thinks, says, and does. Sam can be abrasive. I know that. I find his decade-long quest to discover my net worth and the sale price for GRS a bit bizarre. That said, I enjoyed having lunch with him the one time we met, and I think he does a terrific job of writing about money. I’m going to link to his articles when it’s appropriate. (Sam links to me from time to time, although I’m sure he thinks some of the stuff I do is bizarre too haha.)

I have a greater problem with the commenters on Sam’s site (and MMM’s site) who want to pretend as if they know what happened with MMM’s marriage. That’s complete and total bullshit. The same thing happened when I announced my divorce. People decided they knew my motives, that I was an asshole who just got rich and decided to dump my wife. Not true. Not true with MMM either. But it doesn’t stop people from thinking they know what happened behind closed doors. (MMM and I have talked about our respective situations. They actually sound remarkably similar. And from what I can tell, he’s trying to do the same thing I’ve done since my divorce: maintain a good relationship with the ex. My ex-wife is an amazing person and I’m glad we enjoyed two decades together. But staying together wasn’t right for us.)

I don’t see Sam engaging in any of speculation as to MMM’s motives. Sam is more concerned for MMM’s son. He doesn’t agree with MMM’s decision. That’s fine. Not everyone has to agree on things like this.

Hi JD,

Thanks for sharing your thoughts. To clarify, I’m concerned about how children are negatively affected in a divorce. I’m afraid that because I’m a new dad and also a blogger, that I could also end up getting a divorce and negatively affecting my son to.

My post was a self-reflection on things I should probably do after I found out the news. Often times, a divorce is better for the child if the situation at home becomes untenable.

MMM publicly tweeted out his divorce, mentioned in his Guardian interview about his divorce, and hosted a 600+ comment thread about his divorce for a couple months before I wrote my reflection. I’m not sure why someone would think my self-reflection on how I can be a better husband was “ghastly.” To not reflect at year end on how to be better would be more surprising.

Like JD said, I would think people would be more offended about the endless speculation on the MMM forum. But since Pete owns the MMM forum, and there’s literally hundreds of commenters about his divorce, one would logically assume he is a proponent of discussing the issues of divorce to help other couples in difficult situations.

But I am seriously fascinated by why some people think it is not right for me to reflect on divorce, especially when my situation is similar to Pete’s, while hundreds of other people can on his own forum and elsewhere. I’d like to write a follow up post about this. Feedback welcome!

Sam

Is not my place as a miniscule blogger to defend him but I’m a faithful reader of Sam’s. He is very honest and frank. That might hurt some feelings but if you read the body of his work you can’t rationally conclude he’s mean spirited. Yes he says hard things sometimes. If you don’t like it, don’t read it. The rest of us still will.

Thank you for your thoughtful response, JD. I didn’t want to give FS more clicks, but I went back to his post and see that he’s edited it to reduce the snark and the rude speculation about why MMM divorced. Too bad that what he originally wrote was shameful and mean enough to need to edit it.

Also, he has 13 bizarre paragraphs dedicated to trashing MMM for non-divorce matters. Bizarre, petty and mean.

His original post also clearly insinuated that fame and money are responsible for MMM’s divorce. (And it may still – I didn’t read closely this time.) Disgusting. FS is clearly projecting his own issues and unkindness, as MMM has shunned 90% of fame and money that could have come his way. He willingly lives a non-fame-oriented life and a frugal life when he could do neither.

Finally, if FS really intended to write a genuine post about how to avoid divorce, he would have allowed comments. Instead, he knew he was doing something wrong and he didn’t allow comments to call him out.

I’ve never met FS or MMM. But FS’s handling of this has shown me he’s unkind, petty, and un-Christ-like. On the other hand, MMM’s post on his divorce was graceful, kind, and snarky toward no one.

I understand that a link doesn’t mean anyone supports everything on that blog. But given the nice commraderie in the FIRE space, I suggest boycotting blogs that are this petty and rude.

Uh, there is literally a 600-700 comment thread on the MMM forum with hundreds of people talking about Pete’s divorce for months before Sam’s post. Do you really not sign the dates of each post in his forums?

Are you the internet thought police? Have you not read the hundreds of threads? Sam’s post reads pretty much same since the beginning, and is even more clear than the first. Stop causing drama and making stuff up.

But maybe that’s the genius of Sam? He makes people like you his ambassadors by trying to bad mouth him incessantly. And when people check out his work they end up sticking around bc they find out its really good.

Keep up with the blog commenting, Reddit commenting, and MMM forum commenting etc.

Ask yourself what are the things causing you so much pain? Then focus on fixing it. Nobody will ever want to be with you with so much bitterness.

As a clinical psychologist, it seems apparent to me that you are hurting “NoMoreSamurai.” Sam’s post was an honest, self-efficacy, and wonderful exercise on how to be a better partner.

He’s not projecting. It’s his post and he telegraphs his fears, worries, and areas of improvement.

You, on the other hand, must have something serious going on in your life to lash out. It is amazing how you cannot read your own comments and see how unpleasant and immature you are.

I tell me patients that in order to be loved, they must first learn to love themselves. All the emotions you experience of anger, jealousy, outrage, etc can be put in a box and burned. You need to do so to start new and heal.

I wish you the best.

And one other small point for anyone who is naive enough to think that FS’s purpose was to “reflect on divorce” and his own marriage (which is a translucent joke), FS could have done that by just writing a blog post only about HIMSELF and his wife. Instead he made his post all about MMM, and he did this BEFORE MMM even addressed his own divorce.

JD – wouldn’t you have found it nasty if someone else wrote about your divorce before you did? Obviously, MMM was going to address his divorce when the time was right for him and his family. Instead, FS was the ONLY blogger to get a jump on the matter to 1) get clicks to his blog and 2) have a chance to kick MMM while he’s down and to passively aggressively address some weird issue from long ago.

There’s literally no reason for any blogger to address someone else’s divorce before that person has addressed it. And there’s no reason to do it in any of the other inappropriate ways I addressed in my comment above this one.

JD – many bloggers would give a finger for the kind of web traffic that you linking to them generates. FS doesn’t deserve that given the type of person he’s shown himself to be.

Since I didn’t see the original post I can’t comment on how appropriate it might have been. FS’s behavior may reflect poorly on him, but Pete’s brand is one based on personal judgement and having stuff figured out way more than J.D.’s is, so I don’t have as much sympathy as I might otherwise. His divorce is personal but also relevant to his content. It very much reminds me of a pastor of mine when I was a kid. His wife left him. Since he was a *lifestyle* leader he put it out there for the congregation. Not all of the details, but he needed us to still value his guidance and his personal life was part of his professional credibility. He was a far more humble spiritual leader after that, and much better for it in my opinion.

But ultimately what I think of either man is irrelevant because I don’t want J.D. policing links based on anything but the content and value of those links. The only thing I might compromise on is if he didn’t trust a site to be safe, or thought the author was running a scam or something. I’m sure he has linked to plenty of writers he doesn’t or wouldn’t like personally for any number of reasons. That’s not the job he has taken on and I think his site is better for it.

Your manufactured rage is impressive.

Why did MMM tweet about his divorce and share it in The Guardian interview if he didn’t want anybody to know and talk about it?

MMM has always been a self-assures person who likes to give his smack down opinion of others. You make it seem like MMM is some soft injured puppy or something.

I’m not a fan of FS. A number of months ago he misunderstood a comment I made and proceeded to politely insult me via email (it was one of the weirdest exchanges I’ve ever had) ironically telling me how mean people are on the internet and asking me to stop commenting. I haven’t given him my traffic since. But I’m unclear what you expect. J.D. is the only blogger I continue to read for the very reasons he states: he is open to everyone with something to add to the conversation. I don’t want him policing people because eventually he’d get boring. And since J.D. and I might disagree about more than we agree, eventually he’d have to cut me, too.

And ultimately the post wasn’t bad. I think FS’s post might seem more critical if you read it as being as a contrast (i.e. “I want to be a good husband and father…unlike HIM”), set up with his own story about Pete. But I don’t think that’s a correct reading, if only because FS cares too much about his own brand to risk it on snark.

But, in the end, Pete runs a popular blog that is centered on his life. A large part of his brand is having his life together. Having what some would see as a failure in one of his most important relationships, while personal and painful, is a) a reasonable question in terms of finances (after all, divorce cuts assets in half or less and sets many FI journeys way off track) and b) it may tarnish his brand if he doesn’t seem to have it quite as together as we thought.

After all, this is the internet. Even if insult WAS intended, on the venom scale FS was beyond tame. Pete has made a lot of money online and, if he isn’t, he needs to be ready for the downside as well. FS’s point about personal fame leaving one open to public curiosity is a sad, but true, fact.

Pretty cool that he responded in the first place. You either must have said something really annoying, or he does care to reach out and understand his readers.

Not sure if many large bloggers would ever reach out as they are constantly inundated.

I hope readers don’t think they are some type of gift to the blogger, especially when being critical. Writing is tough work. Wish readers were less neurotic and more supportive.

I respectfully disagree. He responded as a curator of a brand. He didn’t address what I said, just started asking personal questions about my life and finances and when I asked why, he started making backhanded insults until I nailed him down on what I said that upset him. As I said: It was a misunderstanding. I was trying to add a point and he took it as criticism. Once I understood I tried to clarify but he kept talking past me and we never reached any real resolution. He offered to let me write a guest post so I could feel how mean the internet could be, which made me laugh since I guest posted on GRS once upon a time when posts could get over a thousand comments and I know how hard it is. I don’t know if he ever understood me and it didn’t really matter. I realized his website wasn’t for me, and I wasn’t for his site. I ironically came to the same conclusion about MMM and I only shared my history with FS to give my defense of him some credibility.

In the end both FS and MMM are just people. I doubt they’re any smarter or more talented than I am, they’ve just picked a different path. I give them props for putting themselves out there but they are going to make mistakes and not get along with some kinds of people (like me) and that’s okay. I just honestly prefer J.D. if only because his humility makes him a curator as much as an original contributor and he brings way more interesting content together than I’ve gotten from either of the other two.

Can you share your initial comment on which post for me to judge? If not, maybe Sam can dig it up so we can see what you are talking about.

Thanks!

I’d love to read the comment you posted to evaluate for myself as well. There are so many mean people on the internet, but also some clueless people who leave comments and don’t realize they are mean or trolls.

JD, you did better than you expected! A nice remodeled house and you got your website back. That’s huge!

Dr. Lucy

I honestly don’t remember, though if Sam even knows what I’m talking about he us free to share. I’m not even saying it wasn’t poorly worded and easily interpreted other than intended. My frustration was with how he handled it.

I don’t believe someone can be an accidental troll. But we all have our off days when things don’t come out quite as we like. I am aware of this and do my best to be careful about my words.

Ultimately my conclusion, and I believe I shared this with Sam at the time, was that he sees the comment section as a directed conversation. He gives a topic or question and expects that to be the subject. I see the comments as a place where the topic can be expanded and enriched.

Previous to this I also had a number of comments that had been popular (as these things go) and thought I had built up some credibility. But I believe our conflicting use of comments made us incompatible. I’m not a fan. I’m a participant in a conversation.

To clarify: Sam didn’t ask me to leave. I was just not expecting to go into detail and that’s the best summary I had to describe our interaction.

I thought Sam’s reflection on divorce was really great. It’s important everyone reflects.

I’d be shocked too if I was a new parent and also a blogger who kept reading how create life was in the MMM household only for Pete to tweet they’ve been divorced.

It’s good to reflect at the end of the year and in the new year especially. We always want to get better since nobody is perfect.

Kudos to Sam for not publicizing his post either. It’s only seriously nosy people like you who are easily triggered by every little thing that comments and spreads this stuff.

For me, I’m gonna work on my family and my health. After all, isn’t this what the post is about?

JD’s comments and openness are great. Why I keep stopping by.

This is why I love reading you. Its nice to read someone who admits to not getting it right all the time. You seem to be the one financial blogger who isn’t preaching some far out theory on money. I find your posts far more authentic than most of the other blogs and it keeps me coming back.

JD,

Im curious as to why you don’t include your businesses in your net worth? You’ve said in the past that its silly not to include the home you live into your net worth. If i remember correctly you stated that it was similar to “Not including your head in your weight.” Please don’t take this the wrong way i am truly curious because to me it seems the same as not including the home you live in.

Great question! It’s fairly easy to calculate your home’s value. You might not get it exact, but you’ll get close. (Look at my case, for instance. I’ve done a tone of work on this house since we moved in, so I don’t have a precise estimate of how much it’s worth now. But I can guess it’s worth at least what I paid for it.)

Valuing a business is much more difficult, especially one that’s in a situation like mine. I’ve been losing money on the site for a couple of years. It’s only just turning around. Traditionally, you’d value the business at a multiple of earnings. That doesn’t work well with GRS, which doesn’t have a lot of earnings but surely has a lot of potential value. (At least I hope it has a lot of potential value.)

But even for a traditional business such as my family’s box factory, it can be tough to truly measure how much the company is worth. Anyhow, that’s a long answer that doesn’t say much. But it’s my attempt to explain my reasoning, anyhow. 😉

Fair enough! Thank you for explaining!

Plus: if you died your house would be something that has intrinsic value without you. A business like this might have zero value without you.

Overall net worth has declined due to the stockmarket correction and we had an expensive year when a pet became catastrophically ill. (RIP Sky Kitty!)

However, Last Year I:

1) I hit my eFund savings goal. (In the past, every time I’ve come close, there’s been an emergency that’s taken it back down to about $1000.)

2) I increased my retirement savings, including putting all of my 3% COLA in.

3) I reviewed my Amazon subscribe & save, eliminated several items or found cheaper alternatives.

4) Discovered Hoopla & now check it and my local library’s catalog before buying an ebook on Amazon.

5) Switched to a cheaper cable package.

6) Ditched BoFA, moved “petty cash” to a CU (meh), put my “big” savings into a higher yield account.

As an unforseen windfall, I increased my gas savings by $40/month due to a (temporary) change in my work schedule that allows us to carpool 3-4 days a week (instead of just 1 day).

This year I want to:

1) Curb impulse buys made in physical stores.

2) Replace the battery in my phone instead of buying a new one.

3) Evaluate my cable “bundle” and see if switching the landline # to a cell phone will be cost effective (I’ll lose the bundled discount.)

4) Switch our homeowner’s insurance to USAA.

The T-Mobile bill is still high at $111, even after being reduced. Have you looked at Ting or MetroPCS or another low-cost carrier? We consistently stay at <$50 and often <$40 with Ting for 2 phones/2 lines per month. It makes you keep an eye on your data – no streaming movies on the bus – but other than that it's definitely worth it.

Ah. I should point out that the T-Mobile bill includes both me and Kim. My share of that is $50, which I consider good especially considering the awesome benefits I get with the plan (like no charges overseas). I’m a big T-Mobile fan and happy to promote them! 🙂

That still seems high, especially for the budget you’re trying to keep. Do you really travel abroad enough to make it worth it? Could you do a month to month plan and switch to tmobile when you need it?

No judgement from me on it, just asking questions from a different angle.

Hm. I don’t know. Maybe I should look at other cell service providers this year. Maybe I’ve grown complacent with my T-Mobile. 😉

I actually switched a couple months ago from the carrier I’d been with for well over 10 years. I liked them, but my bill was similar to yours, also for 2 people. I had been looking at pay as you go carriers for years but was never happy with what I heard about them.

However Xfinity looked like it would work for our purposes and we switched the last of our lines a couple weeks ago. So far it’s working and our ~$110 bill is down to ~$40, and we increased the number of lines from 2 to 4 and put my mom and daughter on our plan.

I won’t lie: It was a huge hassle to switch. But so far I’m happy with the coverage and price.

I love Google Fi! No contract required and it also works internationally. Each month I pay $20 for unlimited calls/texts, plus $10 per GB of data (but you only pay a prorated amount, for what you use – $5 for half a gig, for example). They also allow you to pay for a new phone in monthly installments over two years, with no interest. Not including the cost of my phone, I pay around $25-30 per month with Google Fi. If you add another person to your plan, their line is $15 per month (instead of $20), plus any data used.

Interesting. I just checked and Google FI is now available in Portland. I could swear I checked a couple of years ago and it wasn’t. (Maybe I’m wrong?) I’ll have to consider this…

We are even from last year, but down 2% from the high in October. We did prepay a few parts of trips for 2019. I don’t include my house or auto (or replacement costs of that auto) in our net worth. Saying that, we are going to work on our grocery spending.

I will enjoy your return to reasonable frugal ideas. Maybe “Stay Rich Slowly”

It’s been so interesting for me to see “the road not traveled” that JW has taken while I’ve continued to be a wage slave, in large part because I can’t imagine actually spending this $ that it’s taken me a lifetime to earn. I don’t think I’d feel comfortable leaving my highly paid job voluntarily until I hit my target # and there would be no need to work ever again. That said, I’m risk averse which is why I enjoy reading your blog JD because I get to see what life is like from the other side i.e. someone willing to spend their savings. Your life looks a lot more fun to be honest. But I’m hoping to hit my # in 5 years or so and then be done for good.

The purpose of this blog is to discuss personal finance, and to allow people to comment and join in on the discussion.

It is sad to see the comments devolve into a nonsense ‘soap opera’ where people endlessly discuss how mean, or immature, or petty someone is… it’s like school children saying ‘I know you are but what am I’.

If your post has nothing to do with the mission of this website, to inform us all about personal finance, and instead is a mere personal dispute, then save it for a blog which discusses the Kardashians.

Welcome Back JD!

What goes up, sometimes comes back down. You have awareness of where that money went and why you did what you did.

I take away two lessons (of many). 1. Intentional spending and 2. Paying attention to details.

You had a plan and knew what your money was spent on. That is so much better than blowing it on stupid stuff.

You also paid attention to detail AND you already have a plan to address the areas of your budget that you are focused on.

The investment markets have corrections/bear markets on a pretty regular cycle – it was bound to happen. The great thing is that the bull markets come back and last longer!

When I read your about your spending I realize I spend too much! I always accept that because I save a lot but maybe I need to revisit this again.

Like you I don’t count stuff in my net worth, house, cars, etc. Most of it goes down and it’s already spent and not making me money.

I was up slightly this year but its not real because my savings is the real reason. That stock market tumble didn’t help!!!