One morning just over ten years ago, I had an interesting conversation at the Crossfit gym. I was “rolling out” — using a foam roller to break up tissue — with the usual group of guys, when one of my buddies brought up this new thing called Bitcoin.

“Bitcoin is digital money,” he said. “But it’s completely private and not tied to a government.”

“How does that work?” I asked. From the very first moment I heard about cryptocurrency, it didn’t seem to make any sense. My friend tried to explain. We all chatted about it for a few minutes, and then we lifted heavy weights and/or sweated extensively and/or both of the above.

When I got home, I googled Bitcoin. Nothing I read made any sense to me. I checked the price. My memory is that Bitcoin was selling for $7 or $8 at the time.

Over the past decade, I’ve been bombarded with info about Bitcoin and cryptocurrency. I’ve made an effort to self-educate, to learn why people consider crypto valuable and why they think it’s the future of money. To this day, I still haven’t found an explainer that has actually explained things well enough for me to truly understand.

This 21-minute video from Slidebean has been most effective at helping me grasp the basics of the blockchain and cryptocurrency, but it still didn’t convince me that this stuff was valuable.

Despite all of this, I’ve found myself gradually being worn down over time. So many people endorse cryptocurrency, including people who seem to be savvy and smart. Kim’s brother, for instance, is a huge advocate of cryptocurrency. He and his wife have netted tens of thousands of dollars by dabbling in cryptocurrency. (They bought a new SUV with profits from one transaction.)

So, last fall, I succumbed to the mania.

Doubling Down on Dumb

After selling our home and buying a new one last year, I had a large chunk of change sitting in my checking account. I planned to put this money into index funds eventually, but was keeping it in cash while we were settling into our new home. I used the money to buy furniture and to repair the roof and so on.

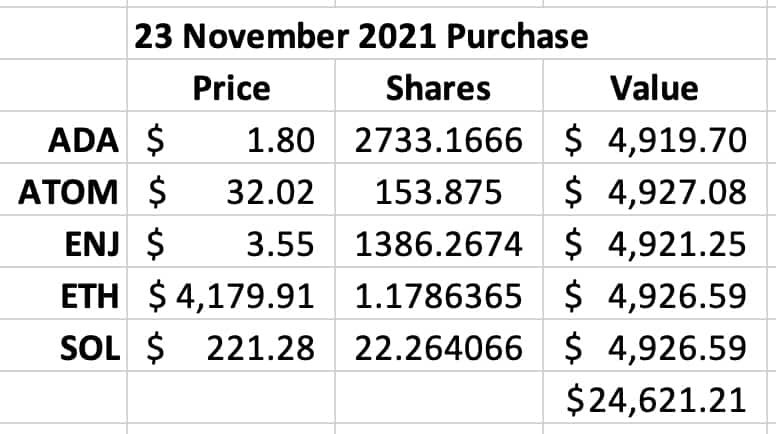

On November 23rd of last year, I decided to conduct a little experiment. The best way for me to learn about cryptocurrency, I decided, was to have some skin in the game, to actually buy some. So I did. I put $5000 each into five different “coins” — a $25,000 investment. I bought Ehtereum (ETH), Cosmos (ATOM), Enjin (ENJ), Cardano (ADA), and Solana (SOL). Don’t ask me why I chose these particular coins. I had reasons at the time, but I can no longer remember them.

Here are my transactions.

Astute readers will be asking, “If you bought $5000 chunks of each coin, then why did you have only about $4925 in each after the purchase.” I’ll tell you why: because transaction fees in the crypto world are outrageous. I used Coinbase as my “wallet” and trading platform, and they took a huge bite out of every transaction. This itself ought to be a red flag. (Or, at least, a yellow flag.)

After moving this money into crypto, I began to feel uneasy. This was in part due to the declining crypto market. You’re always going to feel uneasy when you’re losing money, right? But a bigger problem was that I knew I’d done something foolish.

One of my cardinal rules of investing (for myself) is to not invest in something that I don’t understand. I learned this rule from the writings of billionaire Warren Buffett (one of my personal financial heroes), who applies this to his own investment decisions. Buffett has famously missed the boat on some big companies — Google and Amazon, for instance — because he didn’t understand how their businesses worked, so he didn’t invest. He’s okay with that. He’d rather miss some winners than get sucked into losers. I like that philosophy, and I usually use it to guide my decisions. Usually.

This time, however, I watched as my cryptocurrency declined in value.

I was torn. Part of me wanted to sell, to get out from under the mental weight of this “investment”. But another part of me hated the idea. “I bought high,” I told myself. “I shouldn’t sell low.”

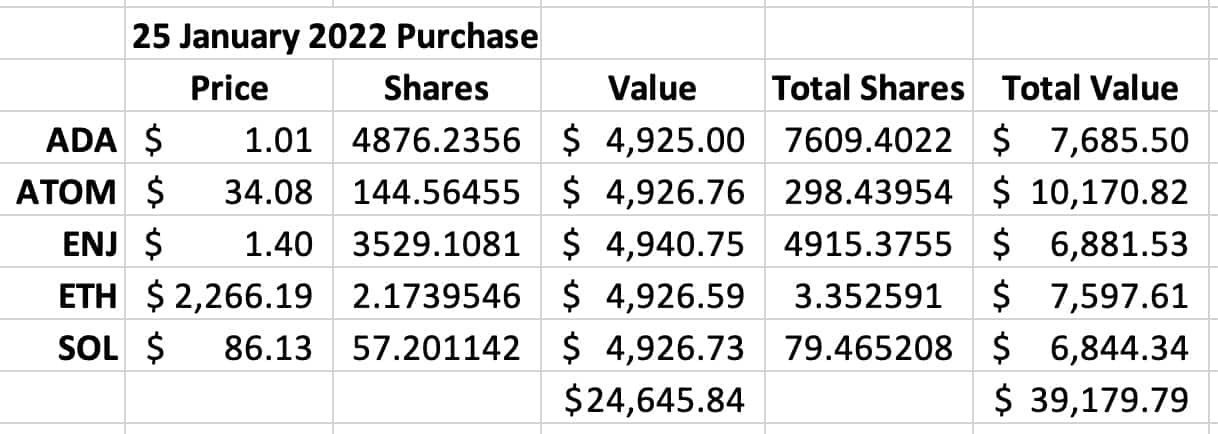

By January, my $25,000 in cryptocurrency had declined in value to somewhere around $15,000. I didn’t want to sell at a $10,000 loss. So, I doubled down on dumb. On January 24th — after a big dip in the crypto market — I put another $5000 each into these same five coins. (I rationalized this as dollar-cost averaging.)

That’s right: Over the course of two months, I “invested” $50,000 into something I didn’t understand and didn’t believe in, something that I fundamentally viewed as a pyramid scheme. There’s no need to tell me how stupid I am. I already know.

An Escape Hatch

February and March were excruciating. Crypto prices remained mostly flat, but with a general downward trend. I was worried that a big crash would come and wipe out all of my money. Then, about the time my cousin Duane’s health began to worsen at the end of March, prices climbed for a week or two. I saw an opportunity. I sold everything.

In the end, I moved $47,750.49 back into my checking account on March 31st. That’s not the $50,000 I started with, but close enough. (And note again how I sold $48,409.91 but only netted $47,750,49. Once again, I lost a ton to transaction fees. This feels like a scam within a scam.)

I believe that my crypto story is typical of most (although perhaps with larger amounts of money). I wasn’t investing. I was speculating. I saw people I know making tens of thousands of dollars on this new technology, and I wanted in on the action. So, despite not understanding how this all worked, I put money into the crypto market. I was gambling.

In retrospect, I got lucky. Yes, I lost $2249.51 in four months, but that’s far less than I might have lost.

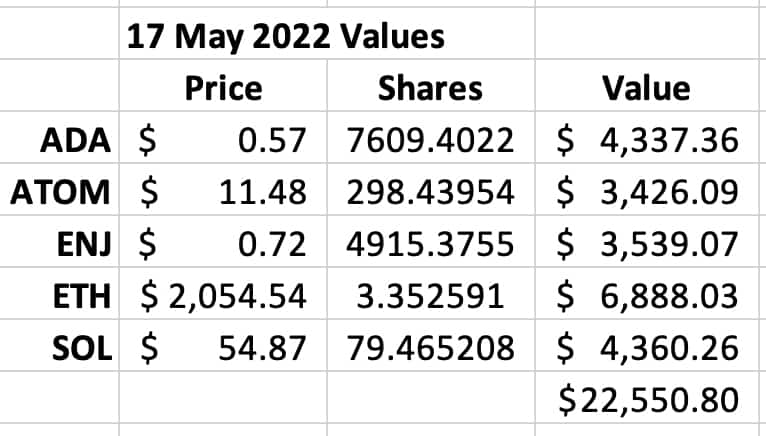

What if I had been so caught up with caring for Duane that I paid no attention to my cryptocurrency? What if instead of selling at the end of March, I sold today? Great question. Let’s look at what my portfolio value would be as of this very moment (about 08:00 on 17 May 2022):

If I had not sold, the value of my coins would be less than half what they were six weeks ago.

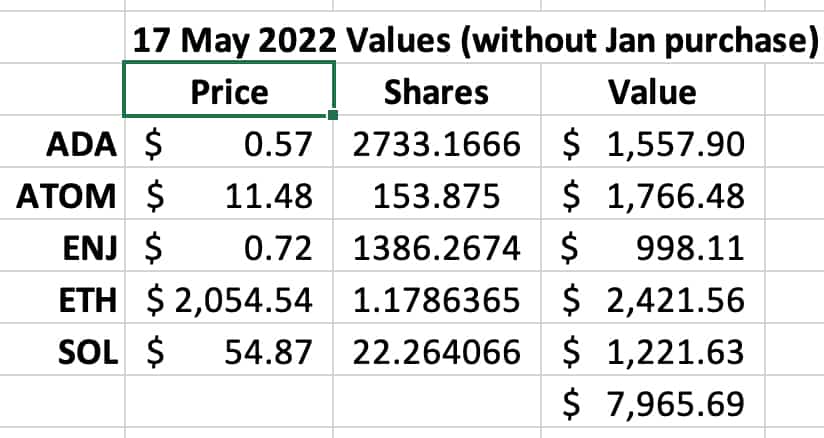

And look at this! Here’s what the value of my crypto portfolio would be today if I hadn’t made the January purchase and the March sale. Here’s what my original $25,000 “investment” would be worth if I’d simply bought and held.

That’s a 68% drop. Holy cats!

Investing in What I Know

Now, I understand completely that I’m not taking a long view here. I’m “day trading”, as it were. This is something I would advise against in the stock market, and I’m sure there are people who advise against it in the world of crypto. For these folks, this is a long game. And maybe they’re right. Maybe prices will soar again. In fact, they probably will at some point. But the more I learn about cryptocurrency, the less I understand, and the more I’m grateful I got out when I did.

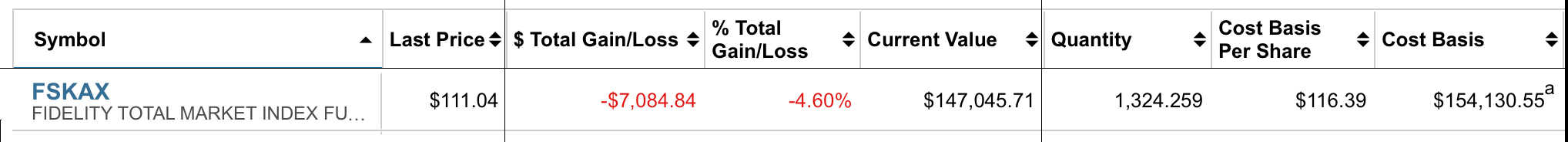

If this is the wave of the future, great. I’m glad some folks will make a lot of money on it. I’m not going to be one of those folks. After an ill-advised mis-adventure, I’ve returned to investing in what I know. On April 27th, I moved most of my remaining cash from the house sale ($154,130.55) into a total market index fund (which, coincidentally, has also lost value haha).

But here’s the thing. Paper losses in the stock market don’t bother me. I understand how the stock market works. I recognize that the stock market allows me to purchase tiny pieces of big businesses, businesses with actual storefronts and factories and datacenters, businesses with customers and sales and revenues. I have confidence that owning a broad-based index fund will allow me to share the long-term growth (and short-term losses) of the world’s business community as a whole. This makes sense to me.

But crypto? I still don’t understand it. And the more I learn about it, the more it seems like a massive pyramid scheme. After a brief foray into the world of crypto, I’ve decided to give it a pass. I’ll sit this one out.

But wait! What if I’d purchased Bitcoin 10+ years ago when I first heard about it? What if I’d, say, purchased 100 “coins” at $8 each, made an $800 investment? Well, this morning Bitcoin is trading at about $30,000 per coin. If I had 100 coins, they’d be worth $3,000,000. That’s a lot of money!

But this what-if scenario assumes that I would have held those hundred coins from the time I first heard about them until today. The odds of that having happened are almost zero. If I had purchased 100 coins at $8 each, I would have sold them long, long ago. I would have sold them before they reached $800. Or $80. I probably would have sold them once they reached $18.

Further Reading

You shouldn’t really take cryptocurrency advice from me because, as I’ve mentioned several times, I don’t understand how the hell it works or why it has value. It makes no sense to me. You should make your own decisions regarding crypto based on the advice of people smarter than I am.

One of those smart people is Nicholas Weaver, a senior staff researcher at the International Computer Science Institute and a a lecturer at the UC Berkeley computer science department. Here’s a long and interesting interview with Weaver from Current Affairs in which he says that all cryptocurrency should die in a fire. One quote:

So the stock market and the bond market are a positive-sum game. There are more winners than losers. Cryptocurrency starts with zero-sum. So it starts with a world where there can be no more winning than losing. We have systems like this. It’s called the horse track. It’s called the casino. Cryptocurrency investing is really provably gambling in an economic sense. And then there’s designs where those power bills have to get paid somewhere. So instead of zero-sum, it becomes deeply negative-sum.

Effectively, then, the economic analogies are gambling and a Ponzi scheme. Because the profits that are given to the early investors are literally taken from the later investors. This is why I call the space overall, a “self-assembled” Ponzi scheme. There’s been no intent to make a Ponzi scheme. But due to its nature, that is the only thing it can be.

And here is a recent episode of This American Life in which host Ira Glass explores the world of cryptocurrency and NFTs (non-fungible tokens).

Finally, from The New York Times (and therefor possibly behind a paywall for you) is the latecomer’s guide to crypto, which does its best to be an even-handed overview of the world of cryptocurrency.

If you know of articles or podcasts or YouTube videos that do a good job of explaining cryptocurrency, please leave them in the comments so that I can add them to this list. Here are a few of the pieces that GRS readers have recommended:

- The problem with NFTs from Line Goes Up channel on YouTube.

- Bitcoin for Beginners from the Afford Anything podcast.

- Web3 Is Going Just Great, a website that cynically catalogs news from the world of crypto. (And here’s a Harvard Business Review profile of Molly White, the woman who created this website.)

Let me know if there are more pieces I should add here…

Wow! And that’s not ‘wow’ to the losses you could have suffered, or the $3M you could have made, or even the extortionate trading fees, but that you succumbed to the temptation! I’ve been tempted, learned about how it works, but have always struggled to grasp where the value is. Sure, the technology has value, but not the value people have been prepared to pay; like the tulip mania of 1637.

Thank you greatly for conducting this experiment, and being brave enough to share your experience.

Unfortunately, you did invest near the all-time-highs for each crypto.

How the hell does it work?

I’d recommend reading ‘The Bitcoin Standard’ by Saifedean Ammous if you would like to learn more about the future of digital finance.

This book uses an Austrian economic lens to examine what money is and makes the case that in the world of digital currency ‘crypto’ projects are scams and there is no alternative to Bitcoin.

Sadly, you did invest near the all-time highs for each crypto; it would only go down from there. And, you did not invest in the King: Bitcoin (BTC).

Personally, I consider BTC the only serious one to invest in, the only one regarded by the IRS as a commodity. The others are, or will be, regarded as securities.

If you decide to try again, I would suggest reading Jeff Booth’s book “The Price of Tomorrow”, and buying just $1,000 – $2,000 worth of BTC and holding it for your grandkids.

If you don’t understand it, just buy that much and hold it for your descendants or for charity when you are no longer around.

Or wait for a spot ETF for Bitcoin (BTC). The Canadians have one, but the Americans don’t yet. But they will, someday.

I’m sorry you had such a terrible experience with crypto assets. I don’t trust other cryptos. I only buy BTC and only for long-term holding, with the idea that someday I’ll be able to take own loans against it, like loans against home equity. I’m holding BTC forever, not just for myself, but for my descendants.

Big difference when gambling on Altcoins versus holding Bitcoin …

Big difference when gambling on Altcoins versus holding Bitcoin